Alibaba?

It’s hot. Everyone wants in.

There is one reason: Comparable companies — Google and Facebook — have done spectacularly since going public.

If you can’t see all the charts in Apple, tap once on your iPad or iPhone. If you can’t see in Windows, right click, then click view image. Don’t get crazy about the big drop in Google. They did a two-for-one split.

Buy Alibaba on day one, i.e. Friday? That’s the BIG question.

Here’s my recommendation: Buy a little. Then wait to buy more later at a, possibly, lower price.

Both Facebook and Google dropped shortly after their opening. The reason? People and institutions who got their shares at the “cheap” IPO price flipped them, meaning they sold them shortly after they went public. They did this because that’s their business — they’re short-term investors. They buy things at the IPO price and sell them shortly thereafter. Most times they make a profit and rely on those profits to pay for their losses on IPOs that won’t work.

Alibaba’s IPO may be different. The underwriters are apparently trying real hard to place the shares in “smart hands.” They want the shares in the hands of long-term holders and they want this IPO to be a success. Their strategy is to find institutions that want to own say one million shares long-term. They will get given 500,000 shares(or so) on the IPO and are encouraged to buy the additional 500,000 (or so) in the aftermarket — at presumably higher prices. This will underpin the Alibaba share price and stop the price dropping.

At one point you could have bought Facebook at $18. It’s now $76.

Will this “smart hands” strategy work? Will shares of Alibaba go steadily up? I don’t know. That’s why I’m suggesting that you buy some shares on Friday and wait and watch. I’d personally be surprised if it didn’t dip in coming weeks. But my ability to predict is as good as yours — nil to none. See 25 Predictions That Didn’t Come True. Click here.

I’ve spent oodles of time reading about Alibaba. Read the Red Herring. Click here. Read the Wall Street Journal, Bloomberg and the New York Times. They’ve each got a zillion stories. I’ve even tried shopping on Alibaba. It’s impressive. (Go here.) A BusinessWeek reporter used it to make 280 pairs of brightly colored pants. He was happy with his pants and the process of buying through Alibaba. Read his story here.

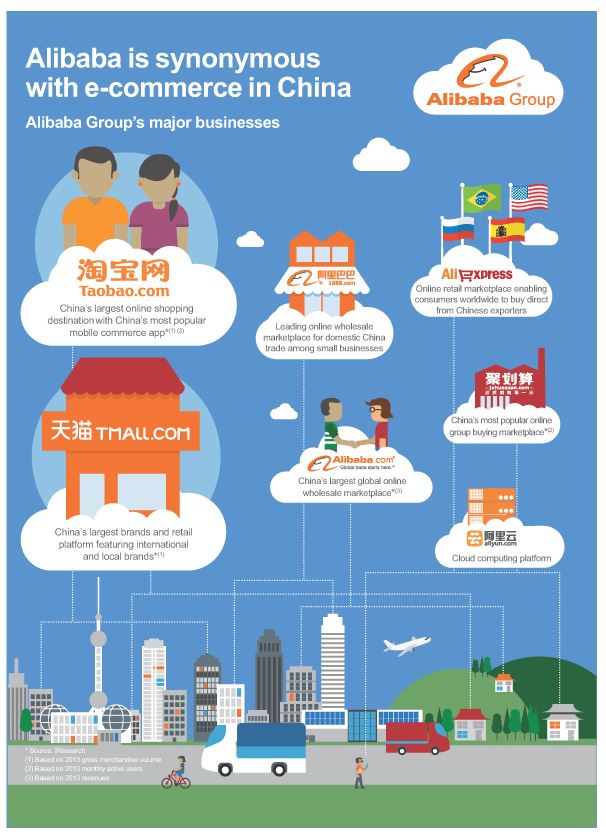

What I’ve learned about Alibaba:

+ Alibaba is huge.

+ Alibaba is sort of a combination eBay/Amazon (but much bigger than both of them combined). It’s really a portal to Chinese manufacturers.

+ Chinese governance and accounting stinks. Read this piece on fraud in China. Click here.

+ There’s massive insider/management in-dealing. This may or may not stink.

+ No matter how big Friday’s IPO, Jack Ma will still control the company. You can read about him on Wikipedia. Click here.

+ Alibaba will create thousands and thousands of new American entrepreneurs — once they discover how easy (and cheap) it is to buy stuff on Alibaba. You don’t have to go there to find someone to make your idea. Alibaba does it for you.

The Wall Street Journal has a piece If You Buy Alibaba, Be Ready for a Rough Ride. Please read this piece. Click here.

I also like this piece in the Journal:

In Alibaba IPO, Investors Offer Views of Risk and Opportunity

Some See a Potential Windfall, While Others Cite Problems With Governance

Click here.

The more I write about Alibaba the more excited I become.

Here are three charts that summarize Alibaba’s business. They’re from the IPO Red Herring on the SEC web site:

Harry Newton whose new granddaughter, Sophie, has such a wonderful personality. Here’s Sophie being, well, Sophie, aged around two weeks. You think we can get her a modeling job?

I promise. No more baby pictures for at least a week. I like being a grandfather. I’m being called Gramps, which is appropriate. She’s learning the expressions.

NO PRICES?? Just “Contact the Manufacturer” … and then an email form?? I think I’ll buy more Amazon stock on Friday. Screw this Alibaba stuff…. it makes no sense to me..

Harry — Here is a hundred million dollar idea for you… I TRUST Amazon. I probably buy something on Amazon three times a week. I know that with Amazon PRIME I might not get the BEST price, but it’s good enough when justified by the super convenience. (I also watch PRIME videos)

I know NOTHING about Baba, BUT I HAVE been burned by doing business directly with Chinese companies online. So, what is needed is an automated Shopper that immediately compares an item on Amazon with an identical item on Baba in terms of asking price, tax, shipping cost, and delivery time AND provides space for reviews from confirmed buyers. Make it browser-based. Go get a programmer and turn it on. Call it BabaOn

Why do business with Alibaba? If you want a digital watch, they show you a price for 50 to 300 of them. Then you contact a middleman to get your final price. I find it problematic doing

business with Amazon too because they advertise free shipping but when you get your cart ready they have added a shipping charge so I just bow out and go to EBay where buying is simple and easy.