Doubt is the greatest investment tool.

When in doubt stay out.

Rule number one: Don’t lose money.

Sometimes your doubt will keep you out of good things (bitcoin?), but it also keeps you away from retailers, biotech, miners, telecom carriers, cybersecurity, Expedia and that bunch of suckerfish, and others I’ve mentioned in recent weeks.

Today, a second day of losses. Except for Square, which continues its incredible climb. Here’s SQ year to date.

Interest rates are edging up. You can now get 1.5% for a one-year CD. Which is better than leaving your cash money in the bank earning zilch. Certainly better than a slap in the belly with a cold fish. For bank rates, click here.

Democracy still works

Among the countries I won’t be visiting or investing in anytime soon — the entire Arab world, Turkey, most of Africa, and of course, Venezuela. Here’s the latest on that sad country, courtesy the Wall Street Journal (a fascinating article):

Venezuela Goes Bust

Another lesson in the price of lending to a socialist regime.

Milton Friedman once joked that if you put the government in charge of the Sahara Desert in five years there would be a shortage of sand. He could have been talking about Venezuela and its oil wealth. But it is no joke.

On Monday Caracas missed interest payments due on two government bonds and one bond issued by the state-owned oil monopoly known by its Spanish initials PdVSA. Venezuela owed creditors $280 million, which it couldn’t manage even after a 30-day grace period.

Venezuela is broke, which takes some doing. For much of the second half of the 20th century, a gusher of oil exports made dollars abundant in Venezuela and the country imported the finest of everything. There were rough patches in the 1980s and 1990s, but by 2001 Venezuela was the richest country in South America.

Then in 2005 the socialist Hugo Chávez declared that the central bank had “excessive reserves.” He mandated that the executive take the excess from the bank without compensation. Today the central bank has at best $1 billion in reserves.

Falling oil prices are partly to blame, but the main problem is that chavismo has strangled entrepreneurship. Faced with expropriation, hyperinflation, price controls and rampant corruption, human and monetary capital has fled Venezuela.

As of Tuesday evening, the Investment Swaps and Derivatives Association still had not declared Venezuela in default. That matters because this will trigger the insurance obligations inherent in the credit default swaps. But S&P Global Ratings declared the country in default Monday. On Tuesday morning the Luxembourg Stock Exchange issued a suspension notice for the bonds with missed payments.

President Nicolás Maduro has formed a commission to restructure up to $150 billion of the debt and put Vice President Tareck El Aissami -who is under U.S. sanctions for drug trafficking-in charge. Mr. El Aissami called a meeting of creditors on Monday in Caracas, which most bondholders did not attend. Press reports said Mr. El Aissami delivered a monologue on Venezuela’s intention to pay and took no questions. He argued that Trump Administration sanctions make it difficult for the dictatorship to arrange refinancing.

The real problem is that restructuring assumes the country can grow again. That’s nearly impossible without a change in policy that will free the economy.

If Caracas doesn’t find a way to settle with bondholders, they will soon ask authorities to seize Venezuelan assets such as oil shipments at sea and Citgo facilities in the U.S. Such are the wages socialism.

Useful stuff

+ Most vendors are offering 15% to 25% discount coupons. If you don’t have one, call. If you buy one thing and give them your email, they’ll send you a 15% coupon for your next purchase. Eddie Bauer is offering 50% off if you use their card — Code is WOODS.

+ UPS has improved its online package sending website, making it easier. UPS will give you a nice discount, if you ask. I’m big on asking. A.k.a. begging.

+ Verizon FiOS is better than cable — faster, more reliable, etc.

+ Install critical Windows updates. They should protect you from new nasties.

+ Your cable TV and cell phone bills are too high. You can negotiate them down. I love the phone. I complained to DirecTV. I said my bill was too high. They asked how much was I willing to pay. I told them. They reduced their bill to my number. I don’t make this up. This is not fake news.

+ Please program your landline to also ring your cell phone. This one act will make you more reachable to your customers.

+ Let gmail deal with your iffy or difficult attachments. I forward my difficult emails to my gmail account, then open them there.

+ Bicycling is great for your pulling the kinks out of your back.

+ Watch out for that last step going down. Often the banister runs out before the last step. Which leaves you in limbo on the most dangerous step in the staircase. Don’t do stupid.

+ Two factor authentication is a pain. But it protects you. Use it. thank you, J.P. Morgan Chase Private Client Bank. thank you Shannon and Amy.

+ Don’t employ your nearest and dearest friend, the real estate broker, to sell your property. Find the best broker and use them. Nan Schiff in Manhattan is the best.

+ There’s always a gotcha. Ed’s Internet is slow as molasses. He calls me and bitches. He calls the cable guy, who arrives this morning ten minutes after Ed has completed his latest speedtest …. And discovered — drum roll — he’s now getting the fastest speeds he’s ever achieved. Over 90 mbps on download. I don’t make this up. But I am killing myself laughing. I do love Ed. He owns Square with me.

Australia goes for gay marriage

Celebrations broke out across Australia after a two-month national vote-by-mail survey came out “overwhelmingly” in favor of legalizing same-sex marriage.

Australian Prime Minister Malcolm Turnbull called for same-sex marriage to be legalized before Christmas.

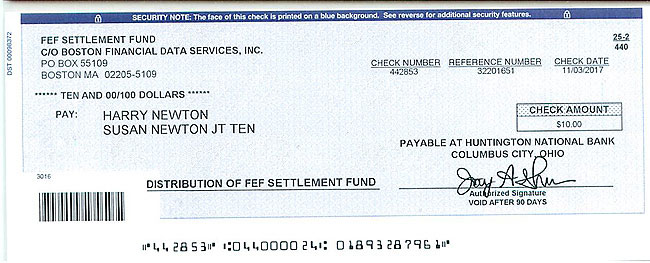

Why it’s always worth joining class action suits

Eat your heart out. Here’s my latest massive winnings. I have no idea what the lawyers earned, but I bet it was more than I did.

Fascinating pieces

Why Businesses Misunderstand Old People

A counterfactual narrative of aging blinds marketers to the real desires of retirees.

Click here.

The Barriers To Entrepreneurship Are Coming Down

Click here.

Delicious puns

+ Did you hear about the fat, alcoholic transvestite … All he wanted to do was eat, drink and be Mary.

+ Seven wheelchair athletes have been banned from the Paralympics after they tested positive for WD40.

+ An Englishman has started his own business in Afghanistan! He is making Land Mines that look like prayer mats!

It’s doing well! Prophets are going through the roof!!

Harry Newton, who played brilliantly yesterday, though he suspects that the pro he beat was playing customer tennis.

Do you want to be like Venezuela? Do you like government and politicians in control and managing wealth? Do you like being in financial slavery to government?

If you are saying “no”…than learn about and join the FAIRtax cause at bigsolution.org

Check out “ARKW” ETF for investment in Blockchain, Bitcoin, Amazon, NVIDIA, Twitter, Netflex, etc

Harry, you like REITs, but I don’t think I have ever seen you talk about healthcare REITs, particularly those with Skilled Nursing Care facilities. Any particular reason?

Which ones are you referring to? I agree that those could be good. I know someone that owns skilled nursing care facilities and they are killing it. They keep buying more in the Midwest.

I was just wondering in general as a category. I have read concerns about the explosion in new units being put up as price competition. Also, lots of talk about defunding certain aspects of their support by the republican tax bill variants although that would probably be longer term. Don’t have a strong opinion, just looking for input. Thanks.

Harry, do you think SQ is still a buy?