This makes no sense.

They close the Government. The market goes up.

They open the Government. The market goes up.

My biggest gainers today are NFLX, AMZN, FB. BABA, CENT, TCEHY (Tencent Holdings), NVDA and GOOG.

These days, I wake up, pinch myself, then go play tennis.

I’d love to buy more of the stocks going up — except they all are.

I’d love to sell the stocks going down — except none are.

Playing tennis has become a euphemism for doing nothing, except fielding questions from friends, “Should I buy more Netflix, Amazon or Square?”

Every stock is so overpriced by all reasonable metrics that most stocks are well into la la land.

Saleforce (CRM) is up today. My Fidelity screen shows it sports a price earnings ratio of 11,289. That could be fake news.

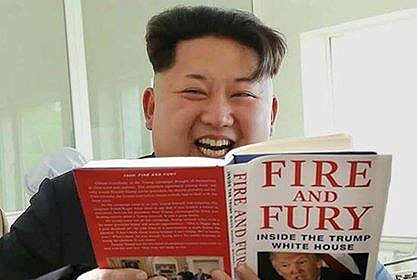

But as Michael Wolff who wrote the book, Fire and Fury, says, It’s a fun read.

And it absolutely is. This is the funnest book I’ve read in eons. Michael was on Trevor Noah’s The Daily Show last night — his four thousandth TV interview since Henry Holt published the book early this month. Noah was angling — in desperation –for one piece of news that wasn’t in the book or hadn’t been revealed on a late night show?

Finally, Noah asked was Trump presently having an affair with someone in the White House?

Yes, and it’s in the book, said Wolff.

Well it’s actually not in the book.

I think it’s this woman:

Her name is Hope Hicks, White House communications director.

But is it relevant? No.

Just as CRM’s 112,89 P/E ratio is also not relevant to its price, or my decisions — Should I buy more or sell what I have?

Or should I play tennis — the preferred decision.

Or watch tennis? The Australian Tennis Open is on. Super exciting matches. Playing on ESPN channels (most of them) and the Tennis Channel. Nadal is out. Djokovic is out. Will Federer win, again? Actually the women’s matches have proven most exciting.

Bryon Wien’s Ten Surprises for 2018.

Wien has been making annual predictions for 33 years. Sometimes he’s right. He’s always interesting.

Excerpts from this year’s predictions. Hint: he’s bullish.

+ The dollar finally comes to life. Real growth exceeds 3% in the United States, which, coupled with the implementation of some components of the Trump pro-business agenda, renews investor interest in owning dollar-denominated assets, and the euro drops to 1.10 and the yen to 120 against the dollar. Repatriation of foreign profits held abroad by U.S. companies helps.

+ The U.S. economy has a better year than 2017, but speculation reaches an extreme and ultimately the S&P 500 has a 10% correction. The index drops toward 2300, partly because of higher interest rates, but ends the year above 3000 since earnings continue to expand and economic growth heads toward 4%.

+ The price of West Texas Intermediate Crude moves above $80. The price rises because of continued world growth and unexpected demand from developing markets, together with disappointing hydraulic fracking production, diminished inventories, OPEC discipline and only modest production increases from Russia, Nigeria, Venezuela, Iraq and Iran.

+ Inflation becomes an issue of concern. Continued world GDP growth puts pressure on commodity prices. Tight labor markets in the industrialized countries create wage increases. In the United States, average hourly earnings gains approach 4% and the Consumer Price Index pushes above 3%.

+ With higher inflation, interest rates begin to rise. The Federal Reserve increases short-term rates four times in 2018 and the 10-year U.S. Treasury yield moves toward 4%, but the Fed shrinks its balance sheet only modestly because of the potential impact on the financial markets. High yield spreads widen, causing concern in the equity market.

+ Both NAFTA and the Iran agreement endure in spite of Trump railing against them. Too many American jobs would be lost if NAFTA ended, and our allies universally support continuing the Iran agreement. Trump begins to think that not signing on to the Trans-Pacific Partnership was a mistake as he sees the rise of China’s influence around the world. He presses for more bilateral trade deals in Asia.

+ The Republicans lose control of both the Senate and the House of Representatives in the November election. Voters feel disappointed that many promises made during Trump’s presidential campaign were not implemented in legislation and there is a growing negative reaction to his endless Tweets. The mid-term election turns out to be a referendum on the Trump Presidency.

+ Investors recognize that the earnings of companies in Europe, the Far East and the emerging markets are growing faster than those in the United States while the price earnings ratios in those regions are lower than those in America. Global investments become more broadly represented in institutional portfolios.

+ Artificial intelligence gains visible momentum. Service sector jobs are automated, particularly clerks in legal and finance professions, as well as workers in fast food outlets and healthcare. Economists begin to question the unemployment data because the rate drops below 4% while so many people still appear to be out of work and seeking government assistance.

+ Cyberattacks become more prevalent and begin to affect consumer confidence. A major money center bank suspends deposits or withdrawals for three days because its system is penetrated. Numerous retail organizations report that customer personal information has been obtained by hackers. Those invading corporate information systems appear to be smarter and more innovative than the internal employees protecting the computer data, suggesting that the systems themselves need to be upgraded.

+ The regulatory authorities in Europe and the United States finally get concerned about the creative destruction of Internet-related businesses. As a result of pressure from retailers and traditional media companies, they begin an investigation of anti-competitive practices at Amazon, Facebook and Google. The public begins to think these companies have too much power.

+ The risks in Bitcoin are so great that regulatory authorities restrict trading. Among their concerns are: no regulatory oversight; no safety and soundness measures; no recourse in the event of mistaken or miscalculated transactions; high cyber risk; no deposit insurance. (Risk source: Morgan Stanley.)

You can read all his 16 predictions here.

Dietary Supplements? Should you take them?

The Week did a piece on the dietary supplements scientists swear by. They had a list.

The last scientist in the roundup reinforces my own belief: “Nothing but real food.”

Tim Spector is a professor of genetic epidemiology at King’s College London.

I used to take supplements, but six years ago I changed my mind. After researching my book I realized that the clinical studies, when properly carried out and independent of the manufacturers, clearly showed they didn’t work, and in many cases could be harmful. Studies of multivitamins show regular users are more likely to die of cancer or heart disease, for example. The only exception is supplements for preventing blindness due to macular degeneration, where randomized trials have been generally positive for a minor effect with a mixture of antioxidants.

In many cases, there is some experimental evidence these chemicals in supplements work naturally in the body or as foods, but no good evidence that when given in concentrated form as tablets they have any benefit. Recent evidence shows that high doses of some supplements can even be harmful — a case in point being calcium and vitamin D. Rather than taking expensive and ineffective synthetic products, we should get all the nutrients, microbes and vitamins we need from eating a range of real foods, as evolution and nature intended.

For the full piece, click here.

Why teachers drink

Harry Newton, who pinched himself as the market closed a few minutes ago. Thank you God. I know this can’t last. If you do close it down, at least give me a down-the-line backhand as a booby prize.

Harry, Best to you in 2018. Keep on working on your backhand and serve and keep those blogs going at your own pace. You seem like a great guy.

I thank God for my health, my wife and my life…you might think about thanking your President for the economy and all that money you are making, rather than making fun or bashing him.

Harry — I’m going to enjoy watching YOUR democrat party dispensed into the trash-bin-of-history far more than you enjoy tennis.

Trump/Russia collusion…….FAKE NEWS

DNC-Hillary-Obama/Russia collusion….REAL NEWS

Harry your evil party is done. Thank God for President Donald Trump!!!!!!!!