This is a two-part piece. What happened? How has it changed my investing?

Part 1.

First, understand what you’re seeing on TV or reading in the financial press on this 10th anniversary is self-serving, pat-on-the-back nonsense. What you hear, again and again is “The world was collapsing. We did a fantastic job saving it.“

What you’re seeing and reading is irrelevant to you — but critical to the gigantic egos of all the players you see being interviewed on bubblevision and written about in the press.

What you should be seeing and reading about is a history of what caused the collapse and an analysis of why nothing was done before it all got out of hand and caused the economy’s death cycle — called at the time “systemic failure.”

Start with the basics: Wall Street is a product machine. It invents products, marks them up, then sells them, hopefully, at a profit. It has no interest in the quality of what it’s selling, except as it relates to their immediate saleability.

So it was with housing mortgages. Wall Street found a ready market for packages of housing mortgages. The key was to make as many of them as fast as it could. Hence, encourage dishonest mortgage brokers to solicit everyone and their uncle to apply for mortgages. Many people didn’t qualify, so the brokers (with the banks’ encouragement) lied on the mortgage applications. They were later called Liar Loans and NINJ Loans (as in No Income, No Job). Someone whose income was $20,000, was changed to $120,000, given a loan and a new house. A few years later (depending on the terms of the loans), the owners couldn’t pay their dues, the loans defaulted and the mortgages became worthless. Hence the name Sub-Prime Mortgages. They should have been called Garbage, Fraudulent loans.

It all spiraled out of control. Bingo we had The Great Recession. It’s very depressing: 11 million families lost their homes, their savings and heir lives. The long-term affects are devastating. Writes the New York Times this weekend:

When the bubble burst, the bedrock investment for many families was wiped out by a combination of falling home values and too much debt. A decade after this debacle, the typical middle-class family’s net worth is still more than $40,000 below where it was in 2007, according to the Federal Reserve. The damage done to the middle-class psyche is impossible to price, of course, but no one doubts that it was vast.

Donald Trump brilliantly used this. His final ad on the eve of the election flashed images of Fed Reserve Chair Janet Yellen and Goldman Sachs CEO Lloyd Blankfein and Hillary Clinton, in what Trump called “a global power structure that is responsible for the economic decisions that have robbed our working class, stripped our country of its wealth and put that money into the pockets of a handful of large corporations and political entities. …The only thing that can stop this corrupt machine is you.”

The message struck a chord.

The plot thickens. The banks’ liquidity problems caused by the garbage sub-prime loans were quickly solved by the Troubled Asset Relief Program, quantitative easing, the Fed’s discount window. The government supported the financial sector in spectacular fashion. Trump was right. Moreover, none of the bankers were ever punished for their sins of actively encouraging liar and NINJ ( pronounced Ninja) loans.

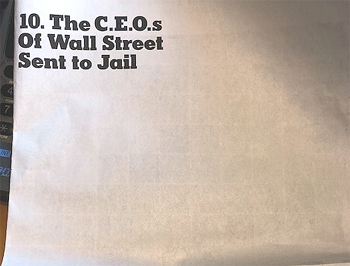

In its Sunday Business special section on “Ten Years Ago Lehman Brothers collapsed,” The Times ran a full -tabloid page that had these words:

The Times wrote:

Like the bankers, shareholders and investors were also bailed out. By cutting interest rates to near zero and pumping trillions — yes, you read that right — into the economy, the Federal Reserve essentially put a trampoline under the stock market.

For homeowners, there wasn’t much of a rescue package from Washington, and eight million (my figure is 11 million) succumbed to foreclosure. Sometimes, eviction came in the form of marshals with court orders; in other cases, families quietly handed over the keys to the bank and just walked away. Although home prices in hot markets have fully recovered, many homeowners are still underwater in the worst-hit states like Florida, Arizona and Nevada. Meanwhile, more Americans are renting and have little prospect of ever owning a home.

The plot actually thickens. Once the banks had scooped up all the foreclosed homes and now had large inventories of homes they didn’t want, a bunch of savy entrepreneurs stepped in to buy the homes cheaply. Some set up boiler rooms crammed with “closers” who had direct lines to banks. There were two key issues: Which houses to buy, given they weren’t allowed to visit the houses and/or didn’t have the time. Second issue was where the get the financing? Step in Wall Street companies including Goldman Sachs and Blackstone.

Part 2. Lesson for Harry’s investing”

+ Stay away from anything and everything that “Wall Street” (in its broadest definition) pitches me. That includes money managers, mutual funds, hedge funds, private equity funds, investment bankers, venture capitalists.

+ Understand that these people are in it for the fees. What’s most amazing about the fees is many of these people get paid fees — even if they lose my money. I’ve seen fees from 2% to 7% if they don’t make me money and over 25%, if they do.

+ Learn enough to be dangerous myself. Stay with public markets. The BIG advantage of public markets is they’re liquid. I can sell my stocks from one moment to another and lose the aggravation. I’ve actually had managers who had my money in stocks that had fallen 90+%. When I asked why they hadn’t sold earlier, they usually replied, “We are hopeful of a rebound.” Bunkum.

+ My investments now consist heavily of stocks — my list is in the right hand column on the blog — and some real estate syndications. Why those? Because I’ve found a handful of great managers. And the results have been good. America is becoming a renter nation — see above.

Over the past 20 years — since I sold my business — I’ve spent time trying to work with some of the Wall Street people. The bottom line is none listen. My frustration is high. Better to work with public stocks and, i I become dissatisfied, sell them instantly, and lose the aggravation.

There you have it. Not very profound. It took only 20 years to learn. And millions of dollars of lost monies. Did I tell you about the biotech fund that came with impeccable credentials and lost 100% of my money. Did I tell you about the investment banker who shrugs off the last eight years of heavy losses with “I made some bad decisions.” Many of his decisions have been 100% losses.

We will have another Great Recession. The Times has a list of what to watch for — all related to excessive debt, and one ring-in — hackers. I’m guessing since they weren’t able to stop the dishonest mortgage brokers, they won’t be able to stop the next recession. Hopefully it won’t be soon.

You can’t find the charts on the Times’s web site. You need Sunday’s print newspaper.

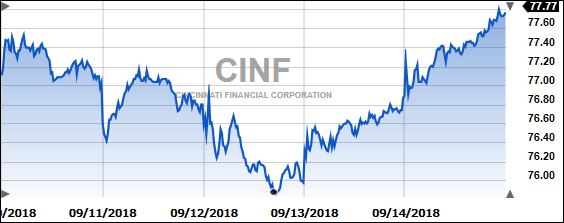

Here’s what happens to insurance stocks when there’s a storm

This is last week in four of the biggest. First there was panic, then realization they have planned for the costs of a big storm. Then they bounced.

Don’t do stupid. More actual stupids.

+ Don’t lift your heavy bag into the overhead bin. You’ll strain your back.

+ Don’t look up when you open the overhead bin. You’ll get hit in the eye.

+ Hold the staircase railing — especially on the final dangerous step, going down.

+ Get up and move. Don’t sit for longer than 20 minutes.

+ Don’t let your little dog go near bigger dogs, especially rescues. Rosie recently lost an eye to to a friend’s bigger dog.

+ Open an file on your laptop and label it “Taxable Events.” Copy stuff into it.

+ Two words we often forget: “Thanks.” and “No.”

All I did was sneeze

Humor or regulation?

Wise Italian Grandfather

An old Italian man in Brooklyn is dying. He calls his grandson to his bedside, “Guido, I wan’ you lissina me. I wan’ you to take-a my chrome plated .38 revolver so you will always remember me.”

“But Grandpa, I really don’t like guns.. How about you leave me your Rolex watch instead?”

“You lissina me, boy! Somma day you gonna be runna da business, you gonna have a beautiful wife, lotsa money, a bigga home and bambinos.”

“Somma day you gonna come-a home and finda your wife inna bed with another man.

“Whatta you gonna do then? Pointa you watch and say, ‘Times up?'”

Harry Newton, who lost in the singles final on Sunday to a brilliant player called Bob Jacob.

Harry …..take a look at CDXC and their product TruNiagen. This company has everything from defending lawsuits brought by corrupt compilation, the rich Asian investor who’s selling TruNiagen in Asia, to an SEC investigation. Take a look, you’ll be intrigued and maybe make some good money.