Last year’s stock market boom was tremendously popular. Many called it The Trump Bump.

This recent stock market slump could cost the Republicans the house.

There are clearly economic reasons: rising interest rates, slowing housing, high oil prices, inflation, slowing earnings (viz warnings from PPG and Trinseo). But none sufficient to cause the huge drop. Somebody had to be selling big-time.

Our Administration is waging economic war with China via escalating tariffs and heavy threats (more about that below). The Chinese have responded with their own tariffs placed on goods of political vulnerability — goods coming from states that the Republicans could lose in upcoming elections. By selling stocks (and treasuries — which they own a lot of), they could bumping interest rates and removing another of area of Trump popularity.

If the Chinese were behind our sell-off, this could suggest that we’re ready for a big bounce. Today’s futures look positive.

Trump, we know, polls well when he starts trade wars. But, with China, he’s gone beyond tariffs and moved to heavy threats.

Ed Yardeni is a market guru. He has a blog called “Dr. Ed’s Blog” and a new book with good reviews.

Buy it here.

In his latest bog, he argues

“that President Donald Trump is implementing policies aimed at either slowing or halting China’s drive to become a superpower. He wants to reduce America’s huge trade deficit with China by forcing US and other manufacturers to move out of that country. In the process, the US would no longer be financing China’s ascent with our trade deficit and providing technological know how that has been either stolen or extorted.

I didn’t have to wait long to get confirmation of my working hypothesis. Consider the following fast-paced developments:

(1) The President’s speech. In his 9/25 speech before the United Nations General Assembly, Trump said only the following about China, focusing on trade: “The United States lost over 3 million manufacturing jobs, nearly a quarter of all steel jobs, and 60,000 factories after China joined the WTO. And we have racked up $13 trillion in trade deficits over the last two decades. But those days are over. We will no longer tolerate such abuse. We will not allow our workers to be victimized, our companies to be cheated, and our wealth to be plundered and transferred. America will never apologize for protecting its citizens. China’s market distortions and the way they deal cannot be tolerated.”

(2) The Vice President’s speech. In a 10/4 speech at the Hudson Institute, Vice President Mike Pence discussed the administration’s policy toward China in far greater detail. He started out by warning: “Beijing is employing a whole-of-government approach, using political, economic, and military tools, as well as propaganda, to advance its influence and benefit its interests in the United States.”

He accused the Chinese Communist Party of using “an arsenal of policies inconsistent with free and fair trade, including tariffs, quotas, currency manipulation, forced technology transfer, intellectual property theft, and industrial subsidies that are handed out like candy to foreign investment. These policies have built Beijing’s manufacturing base, at the expense of its competitors-especially the United States of America.”

He specifically berated the party’s “Made in China 2025” plan for aiming to control 90% of the “world’s most advanced industries including robotics, biotechnology, and artificial intelligence. To win the commanding heights of the 21st century economy, Beijing has directed its bureaucrats and businesses to obtain American intellectual property — the foundation of our economic leadership — by any means necessary.” He accused the Chinese of stealing US technology including cutting-edge military blueprints. “And using that stolen technology, the Chinese Communist Party is turning plowshares into swords on a massive scale,” he said.

He point-blank accused China of economic and military aggression abroad: “While China’s leader stood in the Rose Garden at the White House in 2015 and said that his country had, and I quote, `no intention to militarize’ the South China Sea, today, Beijing has deployed advanced anti-ship and anti-air missiles atop an archipelago of military bases constructed on artificial islands.” The result has been provocative and dangerous near misses between our two navies in the South China Sea.

Pence also documented instances of China using so-called “debt diplomacy” to expand its influence: “Today, that country is offering hundreds of billions of dollars in infrastructure loans to governments from Asia to Africa to Europe and even Latin America. Yet the terms of those loans are opaque at best, and the benefits invariably flow overwhelmingly to Beijing.”

The US has responded by boosting defense spending and slapping tariffs on China. These “exercises in American strength” explain why China’s largest stock exchange fell by 25% in the first nine months of this year. Got that? The US is targeting China’s stock market!

Pence accused the Chinese government of oppressing its own people at home. He railed about the Great Firewall of China “restricting the free flow of information to the Chinese people.” Even more frightening, he said, is the “Social Credit Score,” which, according to the official blueprint, will “allow the trustworthy to roam everywhere under heaven, while making it hard for the discredited to take a single step.” It will be implemented in 2020.

Pence also attacked the Chinese government for meddling in US politics in an effort to weaken America. He claimed that in June, “Beijing itself circulated a sensitive document, entitled `Propaganda and Censorship Notice.’ It laid out its strategy. It stated that China must, in their words, `strike accurately and carefully, splitting apart different domestic groups’ in the United States of America.”

There are lots more complaints about China in Pence’s speech. Clearly, the Trump administration’s policy toward China isn’t just about trade. A 10/5 NYT article critically stated that Pence in effect had declared a “New Cold War” with China. An alternative spin is that Pence was simply recognizing that China has launched an ever-expanding war against American interests.

(3) The poison pill placed in USMCA. A 10/5 CNBC article noted that there is a provision in the newly passed North American trade agreement, the United States-Mexico-Canada Agreement (USMCA, a.k.a. “the new NAFTA”), “which effectively gives Washington a veto over Canada and Mexico’s other free trade partners to ensure that they are governed by market principles and lack the state dominance.” In effect, that’s a “poison pill” aimed at China.

When Trump was elected, I observed that after eight years of government by community organizers, we were about to have a major regime change with government by dealmakers. US Commerce Secretary Wilbur Ross, a consummate wheeler-dealer when he was in the private sector, signaled on Friday that Washington may insist on including this poison-pill provision in future bilateral trade deals. “People can come to understand that this is one of your prerequisites to make a deal,” he said.

(4) JP Morgan’s bearish call. Last Wednesday, JPMorgan strategists wrote in a note that “a full-blown trade war becomes our new base case scenario for 2019” with 25% US tariffs imposed on all Chinese goods. They added, “There is no clear sign of mitigating confrontation between China and the U.S. in the near term.” In his 10/5 Barron’s column, Randy Forsyth noted that the bank’s strategists “estimate that 25% levies on all Chinese imports to the U.S. would trim earnings for the S&P 500 by $8 a share, from their original projection of $179 for 2019. `Such a downgrade would mark the first of the Trump era and potentially end the U.S. stock market rally, even assuming a forward [price/earnings] multiple of 17, unless some other offset materializes,’ they conclude.”

I agree that Trump will probably slap Chinese goods with an across-the-board 25% tariff. I think that the US economy will be strong enough to boost S&P 500 earnings by 6.8% to $173 per share, which has been our number for next year for a while. I don’t think that the escalating trade war with China will be the event that ends the bull market in the US (Fig. 3). However, it may already be marking the beginning of a severe and prolonged bear market in China.

If you were at the receiving end of all this (i.e. you were China’s bosses) I’m guessing you wouldn’t be pleased. You’d be looking for a robust counter-strategy — one, hopefully, not involving outright war — though the drumbeats are pounding.

I don’t like where this is headed since it could tank our stockmarkets even further (after today’s bounce) — by causing more and more CEOs to include warnings in their upcoming earnings statements.

My hope is that the American Administration will dial back the rhetoric and the Chinese may configure some concessions — sufficient for the Administration to sign a trade deal. The clock is ticking. The mid-term elections are 26 days away.

You can read Yardeni’s latest blog here.

Joel Ross of The Ross Rant is super optimistic.

These words floated in this morning

Everyone needs to take a chill pill over the stock market. Ignore all the opinions from the so called experts. They all like to sound off when the press calls. Stand fast, this too will pass. It is October and stocks usually tank in October then recover. GDP will probably be up 4.2% for Q3, earnings will be terrific again, and at 3.1%, or 3.2%, the ten year is still near historical low levels. It is not likely the ten year will move above 3.25% for a while on any sustained basis, and it may float down a bit to 3.1% in the short run. 3.2% on the ten year is still way below its normal level of 5%-6%. With the new core inflation data, the ten year yield is heading lower now. Oil is coming back down substantially. The US is doing great right now. There are issues in much of the rest of the world, as many economies slow down, the IMF warns of further slowdowns, but they are often wrong, and as China slows, which does impact emerging markets, there will be a slowdown but not a crash. There will be very modest signs of inflation in the US as the producer price index was up 2.4%, and as labor costs, and logistics costs rise. However, we are far from bad inflation, and as China slows, commodities prices drop, and oil will drop further, thereby reducing some of the inflation pressure we might otherwise have seen. Amazon and Walmart still have a notable good impact on inflation as they hold down prices even with tariffs. It is a very different economic metrics today than in the past, so Fed, and other economic models that are not taking that into account are missing a key factor change to drivers of inflation. Core CPI in September was only up 2.2% yoy. The core personal consumption expenditure index used by the Fed was up only 2.0%.Rising labor costs cut two ways. It means wages are rising, so consumers have more to spend, especially with tax cuts, and we are going into holiday buying season. So there may be some minor inflation, but it is still low, and wages are still rising faster.

Almost all Christmas goods are already landed in the US, so tariffs will have no effect on Christmas sales. Much of spring buying is already in place, so the China product tariffs will not have a major impact for months. With the rest of the world coming to terms with the US on trade, it is only Chinese goods that get impacted, and there are many sources in other emerging markets in Southeast Asia that can supply product with no tariffs. China’s companies were already moving production to other places, so that will simply accelerate. Housing in the US is slowing, and in some markets, prices and rents are dropping a little, New York being a major example. That is probably good, as home prices have been on a tear for several years, and rent is part of CPI. It is time for a little reset before prices get way out of line like in 2006. These over reactions in the stock market happen periodically, and these days they are often caused mainly by algorithm driven trading, and fear by weak, or young, short term traders who panic. Keep in mind, many young traders, and analysts under 35, have never seen a normal market for treasuries and stocks, or for home prices. And most traders and analysts are under 35. The dollar will remain high, which also helps keep inflation lower. The Yuan drops further making inflation in China more of an issue. If the yuan drops further it will also partly offset the tariff. The US economy is doing very well right now, and will continue to do so into 2019. Earnings season starts next week and should help stocks recoup

You can subscribe to The Ross Rant here.

The Economist says the world is not ready for the next recession

Toxic politics and constrained central banks could make the next downturn hard to escape.

Click here.

Jeff Gundlach is interviewed by CNBC

Gundlach is one of the brightest hedge fund managers around. I watched his entire long interview on CNBC yesterday. I was engrossed. His mastery of facts and statistics is unsurpassed. In general, he doesn’t seem overly optimistic.

If you have time this weekend, read the transcript. Click here.

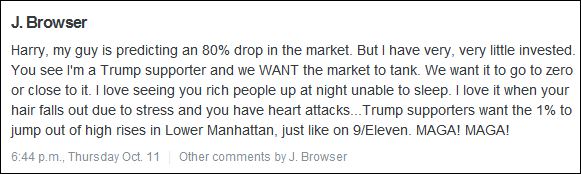

I get emails from readers.

I don’t know J. Browser. I don’t understand his motive for writing such a hate email. No question that the country is polarizing.

Maybe this stuff works?

These are super gut-soothing foods which Nathalie Rhone Nutritionist likes:

Sauerkraut, asparagus, pineapple, onion, garlic, kimchi, ginger and dandelion greens.

For more click here.

Silly old people “humor”

+ My goal for 2018 was to lose just 10 pounds . only 15 to go …

+ How to prepare Tofu:

1. Throw it in the trash.

2. Grill some Meat.

+ I don’t mean to brag but. I finished my 14-day diet food in 3 hours and 20 minutes …

+ Senility has been a smooth transition for me…

+ A thief broke into my house last night . He was searching for money. So I woke up and searched with him…

Harry Newton, who sold most of his Square. With the departure of their powerful CFO, the world has changed for them. I also sold my shares in Nvidia (oversupply of chips) and the few I owned in Spotify (SPOT). I bought shares in Apple, MasterCard and Adobe. I’m hanging onto Amazon. It’s down 16% from its $2,050 high back in early September. Just above my 15% stop loss level. I’m watching eagle-eyed. Should bounce today I’m out of the few Chinese shares I owned, including BABA. I sold them at the beginning of October. This crash has been painful. I thought I was a genius. Now, hundreds of thousands of dollars poorer, I’m not so sure. I get my new Apple Watch today. I’m playing tennis at 10:00 AM. Yesterday, I lunged for a volley. I got it. It landed just over the net, then bounced back onto my side. My first. No video. No audience. But it was delicious. Good memory.

I find it very hard to believe J. Browser is a real person. Do you really believe there is a “trump supporter” who is interested enough in investing to read your blog but wants the market to tank 80%? More likely he is someone with an ideologically motivated deep hatred for anyone right of center

Hey Harry. You need to stop talking to yourself using all these phoney CIA aliases. Feel sorry for the wife and the rest of family. Harvard grad? Goofy f____r. Jake busted your cover and no buddy to talk to…

J. Browser does not speak for what Trump supporters want. J. Browser speaks only for J. Browser.

Most of us Trump supporters want the same thing: a wall; a country for Americans and not illegals who are mostly criminals; an isolationist nation; the crippling of the 1%; and, most of all, the long overdue incarcerations of Hillary Clinton and Diane Feinstein.

Hey Harry, you need to learn to filter out “J. Browser”s, I am even not sure if it is a real person (if they inject Trump with other non-sense, watch out!) but if he is, let him be. He seems miserable. I hear more and more (including the silicon-photonics company I work for) that tariffs are by-passed for some products with qualifying exemptions. One thing I want to tell you about how inconsistent Joel Ross postings are: He talked about US’s competitive fracking technology costing far less to excavate oil to drive conventional producers to lower their prices: when he wrote that the crude oil was about mid $40/barrel. We have seen about mid $70s/barrel since then. So where is the competition from the US? If he believes we have that lever to control prices, wouldn’t this time would be best to utilize it since oil prices drive pretty much everything? BTW, US is getting majority of, to some accounts about 40%, its oil from Canada. You would think Mr. Trump would negotiate that instead of tariffs on dairy which we have a lot of surplus, on dairy alone, already. May be I am missing something. As for his GDP prediction of 4.2% @Q3, I will be happy if we hit mid 3% and probably lower down the road.

Hey Browser. Harry is a spook. Give him credit. Hes relentless when it comes to propaganda cause he has no sex life. Bonehead. Ah hahahaha

Harry, I’ve never sent you an email in my life. That was a comment I posted on your blog. You’re proof that liberals lie and they’re dumb. MAGA! President Trump is bringing back the coal industry and will destroy Amazon, Facebook and the other tech companies. In Trump I believe!

Harry. I see youre still fronting for ur CIA friends. Heres how ur Harvard friend Zuckerberg got exposed for the fraudster he really is. Quote: “Yeah, so if you ever need info about anyone at Harvard, just ask. I have over 4,000 emails, pictures, addresses, SNS (sic). … People just submitted it. I don’t know why. They ‘trust me.’ Dumb f—-s.”

– Facebook founder Mark Zuckerberg from instant message posts, Business Insider, May 13, 2010

ONCE A SPOOK ALWAYS A SPOOK! Propaganda Harry. Why do you really recommend fang BS? Another thing, Stop cutting and pasting all these stupid articles.