I will close 2018 up 1%.

That’s awful for an investment “genius” like me.

I’m not unhappy. Here’s why:

I have a peculiar (i.e. strange) way of measuring my “net worth.”

I do it after I’ve paid the family’s living expenses.

No investment book does it this way. For me, it’s the only logical way.

My father once said a rich man is one who can afford the standard of living he wants to live.

Hence, if you come out ahead after paying all those living expenses — travel, tennis, snow plowing, movies, dinners — you’re rich.

In 2018, I was rich.

I also was stupid. Big-time stupid. In the late Summer/early Fall, I was “rich” beyond my wildest dreams. Every stock i owned — from Square to Netflix, from Amazon to Google, from United Health to Apple — was reaching new highs. Serious new highs.

It was a bull market. I thought I was a genius.

I racked my brain — when will this end and why?

I couldn’t find sound reasons — the economy was doing well, unemployment and interest rates were historically low, etc.

But it did end. And it ended because all bubbles end. No one ever knows why.

When I left Australia in 1966 to come here, my boss said “You’ll love the Americans. You’ll fit right in. Just like you, they substitute enthusiasm for intelligence.”

That was a compliment. Nike has “Just Do It.”

In America, everything moves in cycles of enthusiasm. Sometimes we call them technology breakthroughs. Sometimes we call them bubbles.

This is how investing works.

There are keys:

+ Recognize it’s a beginning bubble. Get in early.

+ Get out before it hits peak.

+ Get out when it starts turning.

+ Get out quickly.

+ Get out.

Here are recent bubbles you could have made a killing on:

+ Bitcoin

+ FANG

+ Marijuana/cannabis

+ Uranium

+ Sub-prime mortgages

+ Gold, silver, platinum, palladium, copper, etc.

Get in when the buzz starts. Get out when your taxidriver/barber/nosy neighbor/great unwashed acquaintances starts asking “Should I buy some bitcoin?”

Bitcoin’s chart is classic bubble.

We need to factor temporary madness into our investment decisions.

It’s more lucrative than “value.”

I’ll write more about this in coming days.

Meantime,

Some things learned over the holidays

+ Send food to sick relatives via Uber Eats.

+ Every appliance — from fridges to washing machines, from boilers to cable modems — need to be protected with surge arrestors.

+ You can take selfies of your family with your iPhone and your Apple Watch. Use the camera app.

+ Sketchers makes the world’s ugliest, but most comfortable shoes.

+ Microsoft has the worst customer service. Don’t buy their software unless you absolutely must.

+ Lenovo makes the world’s most rugged laptops, sporting the best keyboards.

+ YouTube has a video on how to fix anything and everything.

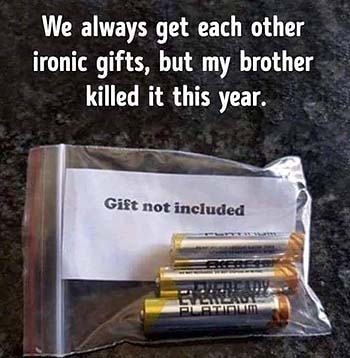

The best Christmas Presents

Best little photo printer: The $99 Canon Selphy CP1300.

The family left our Christmas stay with us with a gorgeous 6″ x 4″ group shot. Nice gesture. Claire’s brilliant idea.

More great presents tomorrow.

Favorite cartoons

Thoughts of moment

+ Do twins ever realize that one of them is unplanned?

+ Maybe oxygen is slowly killing us? It just takes 75-100 years to fully work.

+ Intentionally losing a game of rock, paper, and scissors is just as hard as trying to win.

Harry Newton, who played at 6:20 this morning. I’m running faster. Which is good. Tennis is a running game.

What are you thoughts on MSFT performance over then next 12-36 months??? 10, 20, 30% a year? Someone’s going to do it.

Sell it all. We’re going into a deep, deep Trump Depression, worse than 1929.

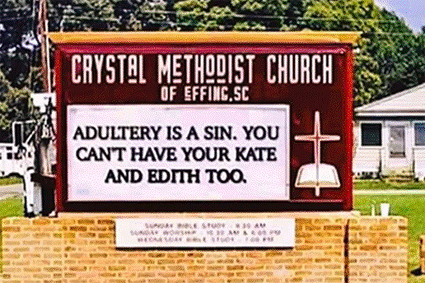

Crystal Meth Church if Effing, SC?

Happy New Year Harry…I love your father’s advise…now I know I am indeed, a rich man!

I’ve been taking my money out of the market because of Trump and Jerome Powell. I have zero confidence in them to do the right thing.

It ended because of Trump.