You can’t value what you didn’t buy and didn’t lose on.

However much I research, “The Rule” seems to be:

+ You research 100 opportunities.

+ You buy ten.

+ You lose on seven.

+ Of the remaining three, two do so-so. One does spectacularly — more than making up for the seven you blew.

The depressing part of this — at least in my brain — is the time spent on the research that ends in a “NO.”

Fortunately I can always get to a NO faster if I know something about the subject. Keep reading.

The big boom in 5G cell phone service

Hot markets move in cycles. When they’re hot, they get spoken off constantly on BubbleVision and written about on all the financial sites.

FAANG was a classic. Hot then. Cold now.

Cannabis was hot. It probably still is. But all I could see was over-production. and hence I missed that one.

5G cell phone service is hot. It’s an area I understand. We need 5G and we will use it big-time. From on-line gaming, to streaming video on your cell phones to connecting the IoT (Internet of Things).

From Steve Schoen, my telecom expert and collaborator with me on Newton’s Telecom Dictionary — click here:

Pre-5G services, dubbed “5G,” have been launched worldwide, not just in the U.S., conforming to parts of the 3GPP 5G specification that have been finalized. Billions have been spent worldwide for this. The services are delivering performance that 4G services don’t deliver.

What is happening is analogous to the commercialization of 4G services before the 4G specs were finalized, and is analogous to the commercialization of 3G services before 3G specs were finalized, and is analogous to the commercialization of 2G services before 2G specs were finalized.

Demand and use cases exist for 5G, and 5G benefits are deliverable now, even though parts of the 3GPP 5G spec still are unfinished. Enough of the spec has been finished for 5G services to be launched now to meet demand.

According to Seeking Alpha, there are seven 5G stocks to play:

+ Nokia

+ Ericsson

+ Qualcomm

+ Skyworks Solutions

+ Apple

+ Samsung

+ Netflix

Cramer also likes Broadcom. I like Skyworks Solutions (SWKS). But I need to do more research.

You can read the Seeking Alpha report here.

Oh Sh*t

Some $137 million worth of the cryptocurrencies Bitcoin, Litecoin and Ethereum are frozen and inaccessible in a Canadian digital platform called Quadriga, after its 30-year-old founder and CEO, the only person with the password, died. The company reportedly owes money to 115,000 affected users. “Despite repeated and diligent searches, I have not been able to find them written down anywhere,” the founder’s widow said of the password. [Reuters]

Ancient wisdom:

When in doubt, stay out.

When you just don’t know enough, stay out.

When you’re not “the world’s leading expert,” stay out.

In what you don’t know,there’s always a Gotcha.

Dying with the password to the accounts of 115,000 people is a large Gotcha.

Choppiness in the markets?

I read this morning:

The % of SPX stocks trading above their 50 DMAs has risen from 10% to 85.5% in the past month. The last time the current reading was achieved was in January of 2018, as noted that was followed by a few months of choppiness in the markets.

Jargon explained

In bond language, YTW actually means Yield To Worst, not Yield to Worse, as I mis-typed yesterday.

The yield to worst (YTW) is the lowest potential yield that can be received on a bond without the issuer actually defaulting. The YTW is calculated by making worst-case scenario assumptions on the issue by calculating the return that would be received if the issuer uses provisions, including prepayments, calls or sinking funds. This metric is used to evaluate the worst-case scenario for yield to help investors manage risks and ensure that specific income requirements will still be met even in the worst scenarios.

The absolute meanness of mad leaders

Maduro has destroyed Venezuela. Million per cent inflation. Mass starvation. No medicines. Three million had fled the country. I’ve read so much, I feel I’m inured to Maduro’s insanity. But no. This morning’s photo blew me away.

The Venezuelan military (which supports Maduro) has blocked a major highway link with Colombia to prevent opponents of the government from bringing donated food and medicine into Venezuela.

For more, click here.

Look what Assad did to Homs, the third largest city in Syria. He destroyed it.

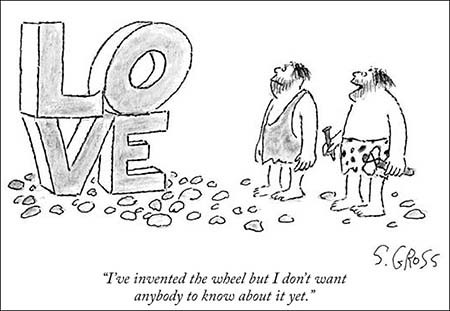

Best New Yorker cartoons this week

Harry Newton, who notes with alarm how stocks like AMZN, Google, and NFLX have suddenly become very choppy, and very very weak. I have small positions. But the last time I invoked my Inviolate Stop Loss Rule, it came back to bite me as the stocks bounced back, beginning around Christmas, 2018. Today’s market is depressing. Nasdaq is down 1.53%. Yuch.

Hey Harry, if you think that the DWS-Awan Brothers scandal is going nowhere……think again.

You and your evil democrats are Fucked….with a capital “F”

That Billy De is one great NYC Mayor…..LOLOL!!!!!

Hey Harry, why are democrats such pussies?

……at some point you and your evil democrat party are going to be forced to face reality.

……RBG & DWS…….you’r fucked.

……Julian Assange paid Seth Rich for the emails…you’r fucked again.

Harry, you are missing the boat on crypto. Crypto is the future! Check out what Brian Kelly the crypto master on CNBC has to say about it. Soon, probably in two-three years, you will be unable to pay for goods and services with plastic or cash; you will only be able to pay with Bitcoin, Ripple, Ethereum or one of the other of hundreds of crpytocurrencies. GET WITH THE PROGRAM.