Check recent stock price movements. You’ll see many are turning down. Is this the end of our nice two year run?

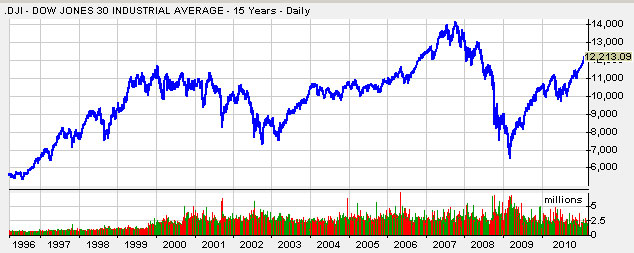

Here are two charts showing the Dow Jones and the NASDAQ over the past 15 years. What can we read into them?

Conclusions:

1. Markets go in cycles of irrational emotion.

2. They tend to reflect what’s going to happen 9-12 months in the future.

I see caution out there. I don’t see the “bargains” of nine months ago. I fear for what might happen if the problems of the banks and the local/state governments become even more obvious.

The lesson?

More cash and tight stops.

Is the world about to end, again? That’s the title of a long article on the stock market on a web site called Financial Sense. The article begins:

Short answer: all things are possible, but change on the margin says no. With the US stock market hitting its three year anniversary this week, investors are getting skittish as fears mount about an impending bear market. Are we seeing the same signs of an imminent market top like we did in 2000 and 2007?

When it comes to the markets, they are not as concerned about absolute levels as they are about change. Yes the unemployment rate is in the high single digits, but the market has already discounted this. More importantly, which direction is the unemployment rate headed? What is the change on the margin? Since October of 2010 the unemployment rate has peaked and has been steadily falling. Moreover, the National Bureau of Independent Business (NFIB) Hiring Plans Index suggests that the unemployment rate should continue to improve into summer and even fall to 8%.

Why Anxiety Remains High

While the economy is improving on the margin this has still been an atypical recovery that feels like we are just moving along at a snail’s pace. After more than a year and a half past the recession being officially declared over by the NBER in 2009, consumer sentiment is just starting to show signs of life and the decline in consumer credit is showing some bottoming out. That said, with all the money thrown at the economy, is this as good as it gets? Are we really getting that much bang for our newly printed Fed dollars? From my standpoint, I think we really are beginning to run on fumes and unless Fed Chairman Bernanke launches QE3 this year in a “shock and awe” manner we may finally come to the end of this bull market and economic expansion.

The article concludes with this chart:

And these words by the author:

I do believe that we are approaching the ninth inning of this bull market, but with the Fed destroying the value of the USD I’m not turning bearish just yet. I’d rather wait until the game is over and see the evidence of this by the crowds getting out of their seats to head home than pick a market top, which, as the bears during last summer’s sell off found out, can be very dangerous. Rather, monitoring the trend of the market may be the best tool to gauge when the final out for this bull market has occurred. I’ve highlighted some trend following tools in the past such as the S&P 500 15/40 weekly exponential moving average system or the S&P 500 in relation to its one year moving average. These two tools shown below show that the trend is still bullish for the S&P 500, and the bulls and Fed should be given the bullish benefit of the doubt until the trend turns bearish as it did in 2000 and 2007.

You can read the entire article here.

Meantime, Richard Russell writes:

Meanwhile, the stock market seems to have gone psychotic. From their recent fear-drenched lows, the Dow and the S&P have just about doubled. It’s madness on the East coast. “Buy the techs.” “No, buy the big blue-chips.” “Wait, buy the energy stocks.” “Buy anything, but just buy.” Is out-of-control Charlie Sheen the poster boy for the new psychotic stock market?

Has Ben Bernanke in his frenzy to bring back “a little inflation” whipped up yet another bubble? This is the fastest market recovery since the 1932 to 1937 post-crash market, a bull market that followed the Dow’s frightening Depression low of 41.22.

There are times when you can forget technical analysis, when you can forget values, when you can forget everything you ever learned about the stock market. This is one of those times. I liken it to Charlie Sheen’s handling of his public relations. It’s a great drama and tragedy to witness. Here’s the highest paid actor in the top comedy on TV losing his marbles. Is it drugs, has he been pushed off the edge by fame and money, or is he just schizophrenic? We might ask the same of the stock market. For it’s high-drama, and a sight to behold.

All our experience tells us that this is a dangerous market. It’s surged ahead ever since its February 2009 low. And what’s more, it’s been backed by an increasing amount of good news; it hasn’t been climbing the traditional wall of worry.

When the stock market roars out of the bounds or when it steps beyond ordinary analysis, I stand aside and depend on my instinct. My instinct, at this point, brings up three words, “Be damn careful.”

I read a lot of advisories over the weekend, and I haven’t been able to find anything by any advisor that has struck me as the bona fide answer to this market.

Personally, I’ve reduced my position in DIAs to a minor amount (a manageable sum). I like to sleep peacefully at night. My own largest position continues to be in gold and silver. Although the precious metals have done well, I don’t sense or detect any insanity in this area.

And my thought, as always is, “Don’t put yourself in a position to take the BIG loss.” Remember, if you take a 50% bath, you have to double your money to end up even.

Personally, I believe Russell. This is a very dangerous stockmarket. Cash is definitely king.

Why females should avoid a girls’ night out after they are married….

The other night I was invited out for a night with the ‘girls.’ I told my husband that I would be home by midnight, ‘I promise!’

Well, the hours passed and the margaritas went down way too easily.

Around 3 a.m., a bit loaded, I headed for home.

Just as I got in the door, the cuckoo clock in the hallway started up and cuckooed 3 times.

Quickly, realizing my husband would probably wake up, I cuckooed another 9 times.

I was really proud of myself for coming up with such a quick-witted solution, in order to escape a possible conflict with him.

(Even when totally smashed… 3 cuckoos plus 9 cuckoos totals = 12 cuckoos MIDNIGHT!)

The next morning my husband asked me what time I got in, I told him ‘MIDNIGHT’… he didn’t seem pissed off in the least.

Whew, I got away with that one! Then he said ‘We need a new cuckoo clock.’

When I asked him why, he said, ‘Well, last night our clock cuckooed three times, then said ‘oh shit.’ Cuckooed 4 more times, cleared its throat, cuckooed another three times, giggled, cuckooed twice more, and then tripped over the coffee table and farted.

Harry Newton who is happy with Edwards Brothers. They instantly dropped their $70 storage charge. But they forgot to ask me, “Would I like them to print this year’s dictionary?” I remember when times were tough in our business, we doubled our sales efforts. Be extra extra nice to customers. Win a little of their business. If you’re running a business, call your top ten customers this morning, tell them you love them and ask them how you can help in these tough times? Send them flowers as an appreciation for their business. Attend to your customers. It’ really works.

What are the opinions of “being in Cash”? Obviously not equities.

Gold?

Cd's?

T-Bills?

Munis?

Paper Currency?