Some friends are gobbling up tech “bargains.”

Some are panicking and selling everything.

Some are “re-balancing” their portfolios — selling tech and buying consumer staples (which do well when tech doesn’t).

Me? I’m nibbling at cheap, fallen stocks, like MasterCard, Adobe and Apple.

But I’m not selling anything. Every time I sell something, it rises. And usually within ten minutes. This is an absolute guaranteed way to make me feel really stupid and magnify the pain I’m already feeling from the falling market.

The professional bears are coming out in force. They are now popular guests on BubbleVision and in “hot” columns like Business Insider.

There are people who are always bearish. Every ten years they get it right.

OK. Where now?

Stock prices stem from four factors:

+ Earnings.

+ Future guidance. Which typically comes with earnings news.

+ Analyst opinions.

+ Prevailing sentiment. That’s everything from interest rates to Senate hearings, from emotional buzz to employment reports, from a dot-com bubble to November 6 elections.

Right now there are no earnings. They start next week. So earnings couldn’t be messing up stock prices. Anyway, tech earnings should be good.

There are some analyst opinions. Some make a difference. Some don’t. Square has opinions both ways — it should be higher; it should be lower. It fell badly — 9% — yesterday.

I have no idea what happened to tech stocks in the past several horrible days. I know they went down but why? I heard every conceivable story — from the Fed raising interest rates in the specter of inflation, housing slowing dramatically nationwide, hedge funds locking in their gains by selling, to the zoo at the Senate, to just natural profit taking.

The stockmarket never goes straight up and all that.

Maybe it’s just “normal” stuff. Here’s Nasdaq over the last ten years:

Here’s Nasdaq over the last six months.

Suffice, I don’t see anything substantive. Kavanaugh’s ascension was a foregone conclusion. The rest was just circus. Our financial system is not at the precipice — like 2008. But I did read Wikipedia’s Dot-com Bubble entry. Today is not the year 2000. Read Wikipedia. You’ll see why. Click here.

How a New York liberal became The New Couch Potato

In Manhattan live a young couple. Two jobs. Living together.

She berates him for feeling positive about Donald Trump.

“But,” he says, “My paycheck is fatter and we’re living better.”

“Yes, but,” she says. “He’s still a horrible person.”

He says, “Do you like our new couch?”

“Yes,” she says.

He says, “Would you like to give it back?”

“No,” she says.

“Well, thank Trump and his lower taxes.”

And this is how a New York liberal became a couch potato.

True story.

Latest from Joel Ross of the Ross Rant newsletter:

Ignore the low job creation number. 1. It will be adjusted up, just as the last two months were adjusted up by 87,000. 2. Carolina made a big dent of 300,000 jobs temporarily lost to the hurricane impact, so that September number should not mean much on its own. We need to wait to see October before concluding anything. At 3.7% unemployment, the economy remains very strong. The only two times it was lower was during the Korean War and during the Vietnam war when hundreds of thousands were enlisted in the military on a far smaller population base. There are over twice as many workers today than in 1969. In addition, few women were in the work force back then so were not a material factor like they are today. Therefore, it is likely that if they made those adjustments to the data, this would be the lowest unemployment rate in history. We are comparing apples to oranges on unemployment now. Wages continued up moderately by 2.8%, which is not great, but better than inflation. Low income wages rose 5%, and those without even a high school degree rose 6%, so the good news on wages is positively benefiting the most needy, not the top levels. For someone making $12 an hour, that raise is equal to around $115 a month- a lot to that worker who may also get food stamps and pay no taxes. Consumers continue to be extremely positive.

The normal Wall St reaction to good news on the economy is to run up the yield on the ten year, which is now at 3.2%, and then to slam stocks because they ran up the yield on the ten year. In a while these same Wall St geniuses will figure out that 3.2% on the ten year is still very low historically, and will not inhibit corporate borrowers, or most home buyers, once reality sets in. Mortgages are still cheap. Home equity lines are still cheap. When the ten year hits its normal 5% range, then things do happen to slow the economy, but we have a very long way to go before we get there. Maybe two years according to the Fed. So ignore the stock market ups and downs as they will sort out over the next couple of weeks, as they have always done when there is a spike in the ten year yield. Earnings season is about to start again, and it will be strong, although you will note that a majority of company CFO’s are saying they expect earnings growth to slow. It is the job of a CFO to say this so they can beat next quarter. It is unrealistic to think they can produce 22% growth every quarter, so they need to pull down expectations. Maybe it will be less than 22%, but 18% is still great if you own shares, and that sort of growth continues into 2019. Let’s say the earnings growth slows to 15%, so now in 2019 your stock is earning 15% more than in 2018. That is down from 23% now, but still one of the best performances ever. Try to keep some perspective, and ignore analysts. They are mostly arrogant kids who never ran a company. They just think they know better, but they do not, and like politicians, they say things to get attention, and then hope they are right once in a while. A lot of this is not to say there are not risks. In November things could go the wrong way, and the Dems could get control of the House, and then they try to stop the world. In January the capital expense tax boost disappears. QE ends by the Fed. They become just sellers of bonds. And maybe home prices stop rising as fast. Maybe then oil is at $75 or $80 -probably not, but maybe. While next year looks very good, there are black swans all over the place, especially with China.

You can subscribe to his insightful newsletter here.

What happens on November 6 with the mid-term elections will be critical. I suspect the Republicans will prevail. And that will give the market a huge boost.

Wonderful commercial

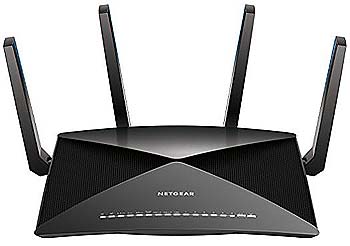

Is your router slowing you down?

Many of us have enjoyed higher speeds from our cable or fiber company. Nice feel-good speeds. But our speed and multi-user abilities at home have been throttled back by our old router. It may be time to upgrade.

You can test your speed by plugging directly into your vendor’s box — and reaching www.speakeasy.net/speedtest/. Write down your speeds. Then move to another room and measure your speed on Wi-Fi. If there’s a big difference, you need a new wireless router. The one to get is

It’s called the NETGEAR Nighthawk AD7200. It costs the grand sum of $390. Your family will love you for it. Click here.

Don’t do stupid

+ Cover your ears. Loud noise destroys your hearing.

+ Lifting heavy bags into overhead bins will destroy your back. Young strong kids will lift for you. Ask nicely.

+ Driving cars will kill you. Especially if you don’t stop for Stop signs. It just killed 20 people this past weekend

+ Don’t bike close to cars. Being “doored” is painful and can put you in the hospital. Taxis are the worst. They stop anywhere. Then the passengers fling the doors open. Then you get doored.

Three wonderful New Yorker cartoons

Isn’t technology great?

My son Michael is moving. He tells me he’s throwing everything out. He feels great.

Michael, can you get what you have left into this moving van –the world’s smallest.

Harry Newton, who sees his portfolio edging up early this morning. Don’t you just love the Couch Potato story? I heard it on the subway yesterday.

What do you mean “That’s so racist” Browser? If you mean the couch potato story I suggest you Google Couch Potato and you will find absolutely nothing racist about it…grow up!

That’s so racist.

I liked the “Couch Potato” story…fine testimonial of our fantastic economy today and to the man that is making it happen…watch for more good things to come!