The economy is doing superbly. 3.25% GDP growth for Q1 is really good. Inflation is low, under 2%.

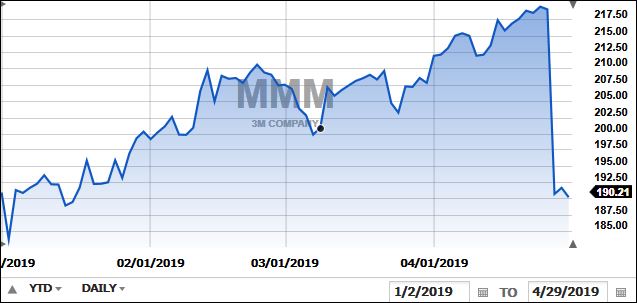

Stocks are generally well-priced. A hiccup in earnings can cause a big drop, e.g. 3M and Google:

For what happened at Google, click here.

Shares of GE are edging up. I bought by putting in an “absurdly” low offer price of $9 and actually snagged some. It closed last night at $9.73. It’s way over $10 this morning. I can see it hitting $12 by the end of the year.

Excellent strategy: Put ultra-low bids in on some stocks (like Google at $1,100) and see what you bottom-fish.

More cockroach news on Boeing

The grounding of Boeing’s 737 Max could cost airlines hundreds of millions of dollars. Airlines around the world are warning that the grounding of the 737 Max aircraft will cost them hundreds of millions of dollars, and analysts say they’ll all want different forms of compensation from Boeing. — Business Insider.

All this is doing me absolutely no good. I’m short Boeing and presently down about $2,000. The overarching lesson remains: Don’t play with investments you know absolutely nothing about — like shorting. For now, I’m holding. I’m getting closer to breakeven.

Sad cartoon:

Recently learned

+ Buying airline miles to apply to airline travel is not a good idea.

+ There are no bargains to buying airline tickets from discount sites, like Expedia. Dealing directly with the airline makes far more sense.

+ You can get two-fer business class tickets to overseas on many airlines or through American Express. Call directly.

+ Spectrum and DirecTV also have streaming video apps. I checked them. They’re no good. The three best ones remain YouTube TV, Netflix and Amazon Prime. Later in the year — on November 12 — Disney will launch a very cheap subscription video on-demand service. For $7 a month you’ll allegedly get lots of Disney movies and some older Disney TV series. I don’t understand why Disney pre-announced the service so far in advance.

+ Paris is really great for men’s clothing. The smaller shows have amazing pants and jackets, etc.

+ Bitcoin still doesn’t float my boat. Here are the last five years.

The New York Times did a piece this morning on “Bitcoin: As Fleeting as Tulip Mania?” In it the author wrote:

SAN FRANCISCO – When you talk to tech industry insiders about where Bitcoin is heading, two vastly different comparisons are inevitable: the tulip bulb and the internet.

Bitcoin’s critics say the digital tokens are like the tulip bulbs of 17th-century Holland. They generated a wild, speculative rush that quickly disappeared, leaving behind nothing but pretty flowers and wrecked bank accounts.

Bitcoin believers, on the other hand, want us to think about cryptocurrencies as if they were the internet: a broad technology category that took some time to reach its potential, even though expectations got ahead of reality in the early years. If that’s true, last year’s crash in Bitcoin prices was like the dot-com bust; a temporary setback before the big ideas come to fruition.

You can read the entire piece here.

+ Apple’s iPhone camera is amazing. 99.9% of us no longer need a separate stand-alone camera. The latest iPhone camera app has Edit which lets you do things with your photos that would have cost you $600 or so with Photoshop only a few years ago. With the iPhone, you can now crop your photos, warm them, cool them or convert them to three shades of black and white. You can draw on them, add text, make boxes and circles. You can have a ball. Claire photographed Sophie and then highlighted where Zoe was. Neat?

This was originally a color picture I took of the family in Hawaii. Interesting effect to convert to black and white. Sort of like an old Italian 1960s movie:

Apple reports this evening. Its stock has risen strongly recently. I wouldn’t be surprised if it pulls back, giving us opportunity to buy more. Put in a limit buy at $180.

Saying NO is therapeutic

Saying NO is hard. There are lots of reason to say NO:

+ Because managing whatever it is will take too much time and aggravation. (You can smell this upfront.)

+ Because you’ll ultimately lose your shirt. You can feel that.

+ Because you don’t need it.

+ Because it’s cheaper to rent.

+ Because you’d rather be fishing, biking, walking, traveling, playing tennis or doing anything else.

+ Because there’s an even better reason to say NO — which Harry hasn’t thought of.

I love my Apple watch even more

It’s super useful on the tennis court. It tells me who’s calling. I can answer, speak, ignore, or message back. Saves huge time.

It shows my messages and emails, shows me my appointments, has an alarm clock, a calculator, tells me the weather, records reminder notes in my voice, alerts me to breaking news, shows how my stocks are doing, tells the temperature, shows my heart rate and how many steps I took today. I can add zillion more apps.

Apple reports this evening. Its stock has risen strongly recently. I wouldn’t be surprised by a pullback, giving us opportunity to buy more. Put in a buy order at $180. (Did I write that already.)

There’s always an opportunity

I met this nice man on the way to tennis yesterday. He said he could sell several hats a day for all the favorable comments he gets:

He bought the hat in a retail store in the Netherlands. I couldn’t find one on the Internet.

As I give more and more stuff away

I feel great freeing up all the space in my closets. Rule: If you haven’t worn it for a year, give it away to someone who will.

Susan: You need to buy one new suit.

Harry: For my funeral?

Susan: Yes!

Comforting.

Wonderful old irreverent George Carlin clip

Caution: It has four letter words and isn’t kind to religion. But it is funny.

I updated the list of favored stocks. Click here.

Harry Newton, who is not pleased with the cartoon the international edition of the New York Times ran on the weekend.

The Times has apologized. But it’s sad, as it comes with heightened anti-semitism all over the world and the weekend synagogue shooting in California where one person was killed and three injured.

I don’t know which is correct here. This from Harry: “The economy is doing superbly. 3.25% GDP growth for Q1 is really good. Inflation is low, under 2%. Stocks are generally well-priced.”

or this from David Rosenberg:

@EconguyRosie

Follow Follow @EconguyRosie

This was a low-quality GDP report. All one-offs – lower imports, higher inventories & Pentagon spending. Real final private sales a puny 1.3%. Removing more lipstick from this pig shows cyclically-adjusted GDP contracting at a 2% annual rate; deepest decline in nearly a decade .

9:34 AM – 26 Apr 2019

David Rosenberg

@EconguyRosie

Follow Follow @EconguyRosie

The top ten stocks in the S&P 500 today account for an incredible near-25% of the entire market cap. As Bob Farrell would ponder, “markets are weakest when they narrow to a handful of blue-chip names.”

5:05 AM – 30 Apr 2019

9:34 AM – 26 Apr 2019