In Joel Ross’s latest Ross Rant, he writes:

Stay calm as the stock market gyrates. Earnings season for the quarter starts next week and the jobs report comes out Friday. Earnings should be good and unemployment will likely drop to 4% and going lower. Nothing changed in the real world. China and the US are making theatrical moves, but they are talking and other nations are in line with Trump on Chinese violations of WTO by China, especially on intellectual property and some industries barred to foreign investment. They will cut a deal with Trump over the next few months. If you want to worry, watch Israel and Syria. The Gaza tension could easily turn into a incursion by Israel. Iran continues to set up bases in Syria, and Israel is going to stop that at some point and then there could be all out war in the Mideast with the US eventually involved to some degree.

Meanwhile today’s New York Times summed the situation up:

Looming China Trade Action Divides Industry and Roils Markets

WASHINGTON – President Trump’s promise to take tough action against China’s unfair economic practices was one of his most popular campaign ideas. But as the United States prepares stiff trade measures and China retaliates, stock markets have plummeted and some of America’s biggest companies are pushing back.

Industry giants like General Electric and Goldman Sachs, as well as agricultural companies, have lodged objections with the White House, saying that tariffs on both sides of the Pacific and limitations on investments will cut off American companies from the world’s most lucrative and rapidly growing market.

China imposed tariffs on Monday on more than 100 American products, including pork, fruit, recycled aluminum and steel pipes. Fears of an incipient trade war between the world’s two largest economies sent the Standard & Poor’s 500-stock index tumbling 2.23 percent and pushed markets into correction territory. Technology stocks bore the brunt of the slump, as a recent spate of bad news about tech companies like Facebook, Tesla and Amazon spooked investors. Asian markets fell more modestly in early Tuesday trading.

China’s action could be an escalation in a much broader trade dispute. The announcement was a direct response to the Trump administration’s tariffs on imports of steel and aluminum, which were directed at a range of countries, including China.

Since then, the White House has announced another trade measure targeted at China that would place tariffs on at least $50 billion worth of products imported to the United States and would restrict investment flows between the two economic giants. This week, the Trump administration is expected to announce a list of Chinese imports subject to tariffs, which could include high-tech products like semiconductors as well as cheap electronics and other goods that many Americans buy.

Josh Kallmer, the senior vice president for global policy at the Information Technology Industry Council, an advocate for companies like Google, Facebook, Apple, Microsoft and IBM, said his group had been largely supportive of the administration’s targeting of China’s unfair trade practices. But the group had made it clear to the White House that it would not be pleased with any measure that had tariffs “as the primary or even a significant remedy.”

“The reason is that it would be a tax on consumers,” Mr. Kallmer said, “precisely the people we are trying to support.”

Many of the trade measures that Mr. Trump has proposed, including the steel and aluminum tariffs, have divided his advisers, the business community and the Republican Party. But the White House has boasted that its targeting of China’s trade practices has broad support from industries on the losing end of the Chinese approach.

That theory could make it more difficult for American companies to operate in a country that already puts up steep barriers.

American companies and business groups have frequently complained that China blocks off valuable markets from American competition, including technology, media and finance, and that it does so in violation of commitments it made when it joined the World Trade Organization in 2001. China has imposed regulations that require American companies to share their technology with Chinese partners, for example, mandating that foreign companies operate through joint ventures if they want access to Chinese consumers. At times, the Chinese have resorted to stealing vital technologies through cyberwarfare, according to United States authorities.

Late last month, the White House said it would crack down on that behavior, outlining a series of actions aimed at punishing China for its trade barriers.

As Mr. Trump advances a series of tough trade measures to confront these behaviors, however, cracks have appeared in American industry’s seemingly united front.

Companies in technology, investment and other industries now say that the measures the administration is taking to help them may actually end up doing irreparable harm to supply chains they have built up over decades. Any American company that wants to be a global player cannot afford to lose access to China’s growing market, executives say.

Technology companies argue that the restrictive measures the administration is taking to help protect them could end up penalizing American manufacturing, raising costs and making their companies less competitive globally. And industries most vulnerable to retaliation, like agriculture, are protesting about losing valuable export opportunities. While the Chinese did not target soybeans in their initial tariffs list, many in the soybean industry worry they will be penalized in a trade dispute given China’s importance as a market for exports.

The 25 percent tariff on pork that China imposed on Monday is expected to be particularly harmful, including in regions that supported the president, like Iowa, North Carolina and Indiana. Last year, American farmers sent more than a billion dollars’ worth of pork to China, their largest export market by value after Japan and Mexico.

“Because we’re so blessed to have America feed the world, we’re also the first industry to get slammed whenever there are trade difficulties between the U.S. and other countries,” Denise Bode, the coordinator for the American Fruit and Vegetable Processors and Growers Coalition.

“American farmers appear to be the first casualties of an escalating trade war,” said Max Baucus, a former Democratic senator from Montana and a chairman of a group called Farmers for Free Trade. “With farm incomes already declining, farmers rely on export markets to stay above water. These new tariffs are a drag on their ability to make ends meet.”

Since Mr. Trump announced the China measures on March 22, American officials, including Treasury Secretary Steven Mnuchin and the United States trade representative, Robert Lighthizer, have been in talks with the Chinese about ways to resolve their differences. The sides have discussed concessions like reducing China’s tariffs on American cars, opening up its market for financial services and purchasing more semiconductors or natural gas, people familiar with the talks said.

However, analysts and companies involved in China said that these measures appeared unlikely to adequately resolve American concerns about China’s longstanding encroachment on American intellectual property.

Companies are waiting anxiously for the administration to release a list of Chinese products this week that will be subject to tariffs – most likely the kind of high-tech products that the administration has accused China of targeting. The retail industry, which lobbied the administration and Congress against an early plan to impose tariffs on Chinese-made apparel and footwear, is now cautiously optimistic that its products will be exempt.

Restrictions on Chinese investment are expected to follow in the coming weeks. Administration officials have said those rules will aim to restore reciprocity with the Chinese, though it is not clear if the United States will go so far as to bar Chinese companies from investing in the same industries that China restricts. The White House is also considering the use of an emergency economy powers act that could allow it to restrict Chinese investments.

The measures come on top of proposed legislation in Congress to expand the authority of the Committee on Foreign Investment in the United States, which reviews foreign deals for national security concerns. Last month, the committee stalled a hostile takeover of Qualcomm, a California-based chip maker, by a Singapore company, largely over concerns about ceding semiconductor prowess to China.

G.E. and IBM, which operate through joint ventures and other partnerships in China and around the world, have both lobbied against the expansion of Cfius over concerns that restrictions on joint ventures with foreign companies that include the transfer of valuable skills or technology could weaken the position of American companies abroad.

Financial firms, including Goldman Sachs and the Carlyle Group, have also expressed concern about investment restrictions, saying they could provide a drag on the United States economy.

White House advisers, in turn, have complained that previous approaches to dealing with China have not worked, and that companies are overreacting to legitimate trade measures.

Speaking Monday on CNBC, the White House trade adviser, Peter Navarro, defended the administration’s tough actions on China and said investors should not fear a trade war.

“Everybody needs to relax,” Mr. Navarro said. “The economy is as strong as an ox.”

Today’s stock market has opened strongly, recouping a little of yesterday’s losses. Even Amazon is up a little.

I suspect Joel Ross may be right in his optimism. Fingers crossed.

Recent wonderful New Yorker cartoons:

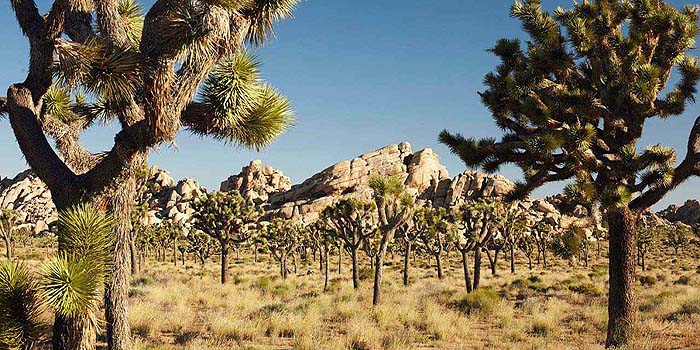

Harry Newton, who’s visiting Joshua Tree National Park today and won’t be able to eye his screens all day. Such joy! Such pleasure!

Go to Joshua Tree later in day when sun is coming down. Best time to go…