Solar for your house makes sense in most sunny places today.

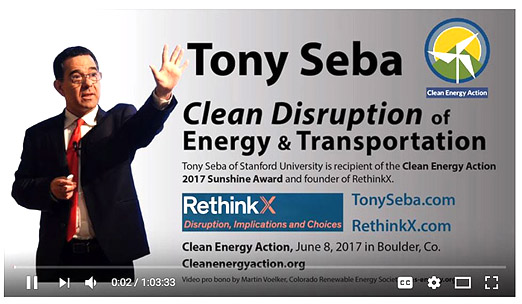

Solar will make increasing sense as it continues to plummet in cost. Don’t believe me? Watch this brilliant video.

Solar can make sense even in states (like Florida) where regulations are not solar-friendly. The goal in those states is to move off the grid entirely by installing batteries. Tesla’s in that business. They call their product Powerwall. For more, click here.

Solar is the new tech. Look at the last five days of First Solar and Tesla:

Here’s the solar article from today’s New York Times. This is break-through for solar.

California Will Require Solar Power for New Homes

Solar panels on a Southern California home. State law requires at least 50 percent of California’s electricity to come from noncarbon-producing sources by 2030.Credit David Paul Morris/Bloomberg

May 9, 2018

SACRAMENTO – Long a leader and trendsetter in its clean-energy goals, California took a giant step on Wednesday, becoming the first state to require all new homes to have solar power.

The new requirement, to take effect in two years, brings solar power into the mainstream in a way it has never been until now. It will add thousands of dollars to the cost of home when a shortage of affordable housing is one of California’s most pressing issues.

That made the relative ease of its approval – in a unanimous vote by the five-member California Energy Commission before a standing-room crowd, with little debate – all the more remarkable.

State officials and clean-energy advocates say the extra cost to home buyers will be more than made up in lower energy bills. That prospect has won over even the construction industry, which has embraced solar capability as a selling point.

“This adoption of these standards represents a quantum leap,” Bob Raymer, senior engineer for the California Building Industry Association, said during the public comments before the vote. “You can bet every state will be watching to see what happens.”

Several California cities have required that some new buildings include solar power, or have made commitments to 100 percent clean energy through various sources. New Jersey, Massachusetts and Washington, D.C., have also considered legislation to require that new buildings be solar-ready, according to the National Conference of State Legislatures. And Hawaii is among the states that have mandated other energy-efficiency measures, like solar water heaters.

But California’s move is by far the boldest and most consequential of any.

California law requires at least 50 percent of the state’s electricity to come from noncarbon-producing sources by 2030. Solar power has increasingly become a driver in the growth of the state’s alternative energy production.

And a new rate structure coming next year will charge California customers based on the time of day they use electricity. So homeowners with energy-efficiency features – a battery in particular, allowing energy to be stored for when it is most efficiently used – will avoid higher costs.

“Any additional amount in the mortgage is more than offset,” said Andrew McAllister, an Energy Commission member who led a building-code review that produced the proposal. “It’s good for the customer.”

The building-code change is one dimension of a broader transition away from centralized power. As with the breakup of the phone monopoly, which allowed customers to choose providers and shop for rates, changes in the way energy is delivered put more control into consumers’ hands.

Those goals have been furthered with smart meters that help control consumption, along with a choice of electricity retailers in many places. And with a combination of residential solar power and battery storage, homeowners can minimize their resort to the grid altogether.

At the end of 2017, California was by far the nation’s leader in installed solar capacity. Solar power provides almost 16 percent of the state’s electricity, and the industry employs more than 86,000 workers.

Under the new requirements, builders must take one of two steps: make individual homes available with solar panels, or build a shared solar-power system serving a group of homes. In the case of rooftop panels, they can either be owned outright and rolled into the home price, or made available for lease on a monthly basis.

The requirement is expected to add $8,000 to $12,000 to the cost of a home.

“Our druthers would have been to have this delayed another two or three years,” said Mr. Raymer of the building-industry group. But he was not surprised. “We’ve known this was coming,” he said. “The writing was on the wall.”

For residential homeowners, based on a 30-year mortgage, the Energy Commission estimates that the standards will add about $40 to an average monthly payment, but save consumers $80 on monthly heating, cooling and lighting bills.

Will Clever, a 67-year-old retired correctional officer, moved into a new house six months ago in Roseville, about 20 miles northeast of Sacramento, where the developer KB Home offered the buy-or-lease option for solar panels.

Not having the $14,000 it would cost to buy the panels, he chose a 20-year lease from SunPower, the nation’s No. 2 commercial solar-power company, for $76 a month.

The Sacramento area can have brutal summers, and having once lived in Phoenix, “I didn’t want to pay a fortune,” he said. “I was looking for a way of fixing my costs.”

So far, he considers it money in the bank. “As electricity costs go up, I don’t have to worry about it,” Mr. Clever said.

California averages about 80,000 new homes a year, with about 15,000 currently including solar installations. Over all, at the current rate of home building, the new requirement will increase the annual number of rooftop solar installations by 44 percent.

The approved requirement is expected to give a strong lift to California’s already hot solar market.

“This is a very large market expansion for solar,” said Lynn Jurich, co-founder and chief executive of Sunrun, a leading solar installation company. “It’s very cost effective to do it this way, and customers want it.”

A little more on Berkshire’s annual meeting

It’s amazing scene. Two old wise guys — one 87 and one 94 — dispensing investment advice for hours to many enraptured thousands. “Thank you for making my grandchildren rich,” said one happy attendee.

Warren and Charlie are very forgiving. I don’t forgive Wells Fargo. But they do and say it’s going to emerge a stronger bank.

They’re very positive on China.

Equities make sense in the long-run. Not bonds.

They like Apple and they bought more. Their reasoning is a little unclear. “We approve of Apple buying more of its shares back. If Apple bought their stock back, we could end up owning 6% or 7% of Apple — for free — without us spending any money.”

Bitcoin is rat poison, they say. “You make money out of productive assets. Bitcoin isn’t one.” I agree with them.

In contrast, blockchain is a legitimate software technique that has legitimate applications outside bitcoin and other rat poison cryptocurrencies.

Buffett and Munger missed Google and Amazon, for different reasons.

Here’s Berkshire stock over the last ten years compared with two Nasdaq ETFs. Click on the chart to see it all.

Facebook is bouncing back.

A blonde city girl named Amy marries a Colorado rancher.

One morning on his way out to check on the cows, the rancher says to Amy: “The insemination man is coming over to impregnate one of our cows today, so I drove a nail into the 2″ by 4” just above the cow’s stall in the barn.

“Please show him where the cow is when he gets here, OK?”

The rancher leaves for the fields.

After a while, the artificial insemination man arrives and knocks on the front door. Amy takes him down to the barn. They walk along the row of cows and when Amy sees the nail, she tells him, “This is the one right here.”

The man, assuming he is dealing with an air-head blonde, asks, “Tell me lady, cause I’m dying to know, how would YOU know that this is the right cow to be bred?”

“That’s simple.” she said…. “By the nail that’s over its stall,” she explains very confidently.

Laughing rudely at her, the man says, “And what, pray tell, is the nail for?”

The blonde turns to walk away and says sweetly over her shoulder, “I guess it’s to hang your pants on.”

Harry Newton. Nvidia reports after the close of business. The report should be good. I’m playing tennis again, my car accident notwithstanding. Yipee. My motto: Keep Moving.

Loved the joke, Harry. My brother is a bovine inseminator!

And the column is right up my alley. I’m in NY for Consensus/Blockchain week, promoting a not-for-profit blockchain clean energy startup, enosi.io. S got in touch so maybe we will have a chance to catch up. I’d love your feedback on our project. We’ve just raised US$1.7m in our seed round.

As you know, I’d worked in university strategy for 15+ years, but this opportunity to pivot my career came up and I’m loving every minute.

Hope to see you this week. I leave Thursday afternoon.

harry – interesting video recently released by boston dynamics, the former google now softbank owned robotics company. pair some of this tech with the google duplex assistant and you’re getting something truly amazing. scary, perhaps. but amazing.

https://www.youtube.com/watch?v=vjSohj-Iclc

https://www.youtube.com/watch?v=Ve9kWX_KXus

https://www.youtube.com/watch?v=lXUQ-DdSDoE

Adding ~$10,000 in average to the cost of a home isn’t trivial. To recover that amount is almost impossible.

Here is a letter from Severin Borenstein, a professor at the Energy Institute at the Haas School of Business

at UC Berkeley to the California Energy Commission.

http://faculty.haas.berkeley.edu/borenste/cecweisenmiller180509.pdf

The BORENSTEIN memo simply makes too much sense…that is why it would never have been considered by California politicians.

I disagree with Buffett and Munger. Bitcoin is a MUCH BETTER investment than Apple stock. I encourage everybody to sell their stocks and buy crypto. DO YOU wANT TO BE RICH? Do you want to provide for your families? Do you want to have respect in your community? If so, then buy crypto. Stocks are poison and turds. You’d have to be out of your mind to buy into this stock market that is just a Vegas casino.