UBS is upbeat on upcoming earnings beats.

BusinessInsider reported UBS analyzed the emotion in 118,000 earnings calls — and the results suggest great news for stocks this earnings seasons.

UBS itself reported:

Strategy: reiterate view for 3%+ Q2 beat in US; multiple uses for the data The positive momentum in net sentiment, an 8%+ Q1 earnings surprise and a solid macro backdrop reinforce our US Equity Strategy expectation for a Q2 beat of 3%+ in the US.

You can read the entire impressive 24-page report here: UBS Evidence Lab Introducing Transcriptlytics

Which S&P 500 fund should I buy?

I’m ashamed to say this. But S&P Index Funds have performed better than ALL the “professionally managed” funds from the likes of Goldman Sachs, Morgan Stanley, Citibank and others (including biotech funds, distress real estate funds, and conventional and distress hedge funds) I’ve been in in recent years.

This is an awful admission. I’m not proud of it.

It’s only in recent years when I took over what I had left that I started to do well. I picked individual stocks (the present list is in the right hand column on the web site) Click here. Allocation is not in the column. But my five biggest stocks by value today are AMZN, SQ, BRKA and B, NFLX, AAPL. They didn’t start that way. Some have boomed in recent months.

The question then is: Which S&P Fund?

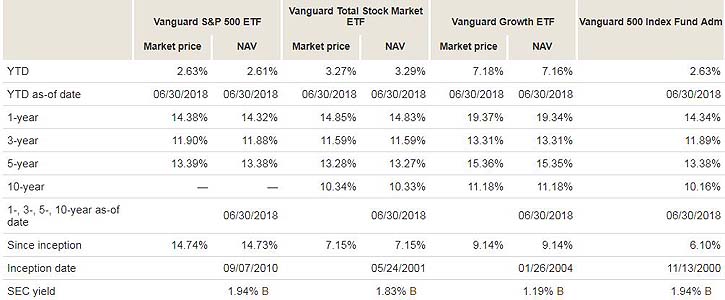

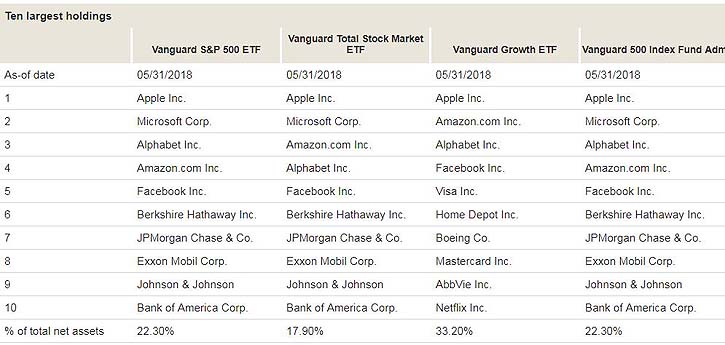

Vanguard is the king of index funds. I went onto their site and compared four S&P funds. Here are the results:

Look carefully at these numbers. Warren Buffett’s favorite index fund is VOO (the first column). Mine is VUG (the third column).

You can make your own comparisons on Vanguard’s web site. Click here.

You do not have to buy your Vanguard funds on Vanguard’s site. It’s not easy for mere mortals. I prefer Fidelity’s Active Trader Pro software which works easier and has more information.

Let me know your thoughts. The conclusions here are 20 years in the making.

Fun advertisement for a Belgium bus company

Favorite signs

Sumfa

A filthy rich Florida man decided that he wanted to throw a party and invited all of his buddies and neighbors. He also invited Leroy, the only Redneck in the neighborhood. He held the party around the pool in the backyard of his mansion. Leroy was having a good time drinking, dancing, eating shrimp, oysters and BBQ and flirting with all the women.

At the height of the party, the host said, ‘I have a 10 foot man-eating gator in my pool and I’ll give a million dollars to anyone who has the nerve to jump in.’

The words were barely out of his mouth when there was a loud splash. Everyone turned around and saw Leroy in the pool! Leroy was fighting the gator and kicking its ass! Leroy was jabbing it in the eyes with his thumbs, throwing punches, head butts and choke holds, biting the gator on the tail and flipping it through the air like some kind of Judo Instructor.

The water was churning and splashing everywhere. Both Leroy and the gator were screaming and raising hell. Finally Leroy strangled the gator and let it float to the top like a dime store goldfish. Leroy then slowly climbed out of the pool. Everybody was just staring at him in disbelief.

Finally the host says, ‘Well, Leroy, I reckon I owe you a million dollars.’

‘No, that’s okay. I don’t want it,’ said Leroy.

The rich man said, ‘Man, I have to give you something. You won the bet. How about half a million bucks then?’

No thanks, I don’t want it,’ answered Leroy.

The host said, ‘Come on, I insist on giving you something! That was amazing! How about a new Porsche and a Rolex and some stock options?’

Again Leroy said no.

Confused, the rich man asked, ‘Well, Leroy, then what do you want?’

Leroy said, ‘I want the name of the Sumabi**h who pushed me in the pool!’

Harry Newton, who marvels at how well the S&P 500 has done in recent years. You will, too. Study my charts. Go on Vanguard’s site.

Tennis is warming up at Wimbledon. The finals are this weekend. Sadly, they won’t include Roger.

40% of my 401K goes to Vanguard 500 Index Fund Admiral (last column) and I also put some 20% to Vanguard targeted retirement funds,2035 and 2045. Our retirement management company does not have ETFs and I am not sure if any 401K portfolio allows that. I am happy with the overall returns, but they are never top performers for a given year but they are one of the best in accumulated average over the last 5 years or longer.

I’ve also wondered over the years how so many mutual growth funds continue to fail to perform as well as a simple index fund doesn’t make sense.