Apple’s new products

The market wasn’t impressed with Apple’s new phones and new watches. Here’s the last five days:

But I was impressed. I rushed to put in my order for the new Apple Watch.

Big features: New health stuff. This thing can save your life. Big heart monitoring. If you fall and don’t get up, it will call someone. Hence huge appeal to alta kakas (old people) like me. From tech site Gizmodo:

In addition to simply measuring blood flow, the Apple Watch can now detect the electrical activity of the wearer’s heart, providing a far more accurate measurement of heart rate, even during vigorous exercise. An ECG can also be used to detect (with an FDA clearance) abnormal heart rhythms, cholesterol build ups, and other conditions before they lead to bigger concerns like a heart attack. The data coming from the Apple Watch Series 4’s on-demand ECG measurements are stored in the iOS Health app, and can be exported as PDFs to be shared with a doctor.

Apple’s also made internal improvements to the Apple Watch Series 4 that won’t be obvious when looking at the wearable, but should be when using it. The Series 4 is the first Apple Watch to make the leap to a 64-bit operating system, with a new dual-core S4 processor that Apple promises is twice as fast, hopefully making it feel a little snappier when loading and switching between apps. But, the new processor and speed doesn’t come at the cost of battery life, with a claimed 18 hours of use between charges.

My new Apple Watch will cost $429 minus $175 I get on the trade-in on my present Apple Watch. Hence a net of $254. Worth it — if it saves my life. Though some readers might disagree.

The new iPhones are bigger and handsomer. I’ll go look at them. I think of the bigger iPhones as mini-laptops. More and more people are running their lives on their iPhone and not carrying a laptop. Hence, there’s a reason to buy the bigger, pricier ($1,000+) iPhone. That doesn’t work for me. I like my laptop. For one, I can’t write this blog on an iPhone. But I’ll go look. there’s an Apple store around the corner on the Upper West Side of Manhattan. Here’s my new Apple Watch:

I have liked Honeywell (HON) for eons. Here’s the last ten years.

Now here comes another reason to love Honeywell. If you own HON on September 18 — that’s next Tuesday — you’ll get free shares of a spinoff called Garrett Motion Inc, which will trade on the NYSE as GTX.

Garrett is in the technology side of the automotive/truck business. As Honeywell writes in the spinoff docs, Garrett develops:

new technologies for the global automotive turbocharger industry, which is constantly evolving. Emerging global opportunities in e-boosting, e-turbos, integrated vehicle health management, and cyber security will be a driving force for the future across all powertrain platforms, including hybrids and hydrogen fuel cells. As an independent company, Garrett will be uniquely positioned to address these challenges with a dedicated team and capital investment strategy that will drive growth in new vectors like electrification and connected vehicle technologies.

Garrett itself writes:

In order to address stricter fuel economy standards, OEMs (companies who make cars, trucks, buses, etc.) have used turbochargers to reduce the average engine size on their vehicles over time without compromising performance. Stricter pollutants emissions standards (primarily for NOx and particulates) have driven higher turbocharger adoption as well, which will continue in the future, with a total automotive turbocharger sales volume CAGR of 6% between 2018 and 2022, in an industry with a total automobile sales volume CAGR of approximately 2% over the same period, in each case according to IHS and other industry sources. In addition, increasingly demanding fuel economy standards require continuous increases in turbocharger technology content (e.g., variable geometry, electronic actuation, multiple stages, ball bearings, electrical control, etc.) which results in steady increases in average turbocharger content per vehicle. Powertrain electrification. To address stricter fuel economy stand

To address stricter fuel economy standards, OEMs also have been increasing the electrification of their vehicle offerings, primarily with the addition of hybrid vehicles, which have powertrains equipped with a gasoline or diesel internal combustion engine in combination with an electric motor. IHS estimates that hybrid vehicles will grow from a total of approximately 4.6 million vehicles in 2018 to a total of approximately 18.1 million by 2022, representing a CAGR of 41%. The electrified powertrain of hybrid vehicles enables the usage of highly synergistic electric-boosting technologies which augment standard turbochargers with electrically assisted boosting and electrical-generation capability. Furthermore, the application of electric boosting extends the requirement for engineering collaboration with OEMs to include electrical integration, software controls, and advanced sensing. Overall, this move to electric boosting further increases the role and value of turbocharging in improving vehicle fuel economy and exhaust emissions.

OEMs are also investing in full battery-electric vehicles, which have gained in popularity in recent years. However, IHS and other industry sources expect that they will compose only 4% of total vehicle production by 2022 due to their inherent limitations in driving range and recharging time and their relatively high cost. As OEMs strive to solve the issues of full battery electric vehicles, they are increasing investment in hydrogen fuel cell powered electric vehicles. These vehicles, like battery electric vehicles, have fully electric motor powertrains, but they rely on the hydrogen fuel cell to generate the required electricity. The hydrogen fuel cell also requires advanced electric-boosting technology for optimization of size and efficiency.

You can read the spinoff docs here. Seeking Alpha did a postive piece on the deal also. Click here.

Ideas for your Bucket List

For the full Conde Nast Traveler list, click here.

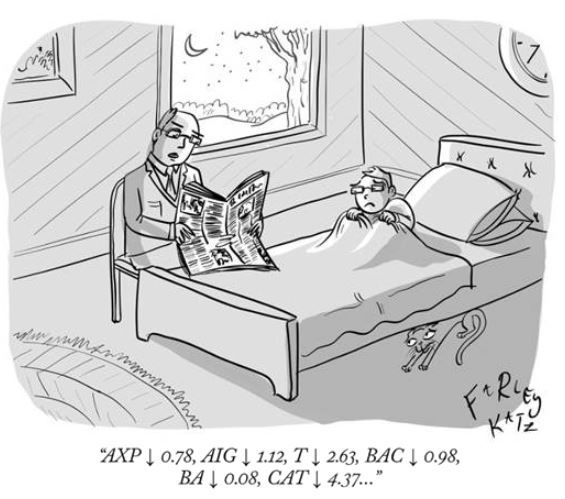

Favorite recent New Yorker cartoons

Harry Newton, who has a truly loving relationship with dentists. Once I sat in their chair as three of them examined me. They looked stern.

I looked up and asked, “My mouth is a disaster?”

They thought about that for a complete nanosecond and replied,

“No, Harry. Your mouth is an annuity.”

Good news (for them).

They’re right, of course.

Last night I bit into something and lost a tooth. Here’s this morning’s selfie:

Charming? I’ll be the homeless hit of next week’s family wedding. Now the family will have yet another reason to tell me to keep my mouth shut.

Harry, regards Garrett, have you considered that perhaps with the federal gov war on fuel economy regs etc that turbos and electric drives may be on the decline in next few years?

Hey Harry, nice selfie. But if you really wanna look like homeless, you gotta have beard man. You have one week to get it going. I am sorry for the lost tooth..but try the tooth fairy 🙂

Harry…my dentist in Algodones Mexico will replace that front tooth for under $500.00 and do a beautiful job! How much will your dentist charge?

What makes you think all those bells and whistles on the new Apple watches will work? Seems to me there’s a huge chance of misfiring signals here.