Our world has suddenly changed.

What looked bright and glorious now looks gloom and doom — suggesting that stock prices are on their way to a lower — much lower level.

Two days ago we were looking to pick up “bargains.” Now we are looking to lock in our gains.

A savvy reader wrote “Harry, what about your inviolate 15% stock loss rule?“

It kicked in and I sold some shares yesterday.

The big selling has been in tech. This is the Nasdaq this year:

Look closely at the chart — the early part of the year. It looks like “We’ve been here, done that. And rebounded.”

The big change from earlier this year is that the Fed is now aggressively tightening interest rates. It is convinced that it needs to reign in rampant inflation — which I don’t see. Remember the old Wall Street adage — “Don’t fight the Fed.“

Cramer, Trump and others are hammering on the Fed to ease off. If the Fed eases off, it could ease selling pressures. As could third-quarter earnings which are starting and which are looking good — 25% up is the consensus.

For now, it’s clear that stock prices will fall more. Some say 10% more. I’ve heard 40% more.

It’s clearly time for another adage: Cash is king. Bring some profits home.

Last night Cramer discussed the crash. Here’s what was on CNBC.com this morning. It sums up where we stand. Please don’t dismiss it because Cramer wrote it:

CNBC’s Jim Cramer knew investors would be counting on him to explain the stock market’s weakness after the Dow Jones Industrial Average dropped over 830 points on Wednesday in its sharpest decline since March.

“When everyone’s terrified, justifiably or not, … I like to step back for a second, get a battle plan going, pull out the ‘Mad Money’ sell-off playbook [to] help explain what’s happening [and] what it will take for the pain to end,” Cramer said. “Spoiler alert: I don’t see it ending any time soon unless we get some major concrete changes.”

The causes of the sell-off – which began shortly after the Federal Reserve raised interest rates and forecast several more rate hikes in an attempt to cool a strong economy – were sixfold, the “Mad Money” host said.

But above all else, he blamed the Fed for not looking more closely at the economic data before announcing its lockstep rate hike plans.

“I am sick and tired of a Fed that reverts to a non-rigorous, non-homework-oriented approach every time things look good,” he lamented. “It’s like they unlearned all the lessons of the Great Recession.”

Sell-off causes

First, with mortgage rates at 5 percent – their highest level in years – “housing is being slammed in reverse” as mortgage applications fall, Cramer explained.

“We aren’t seeing a lot of homes trading. You know what that is? That’s a classic sign that we’re about to get a big break in prices,” he said. “Yep, in many areas of this country, especially areas where prices have run up in the last few years, your house is declining in value.”

Second, PPG Industries and Trinseo – two industrial companies considered to be barometers for the economy – have signaled that auto sales are hitting a wall, causing price declines and major sell-offs in shares of automakers like Ford.

Third, there’s a slowdown in lending, particularly construction lending, suggesting to Cramer that the big banks’ earnings reports on Friday could reveal sinking loan demand.

Fourth, “the basic building blocks of the economy,” namely packing materials like linerboard, are dropping in price, Cramer said.

“No one ever seems to notice this kind of telltale sign of a slowdown until it’s too late,” he said. “You want a more obvious tell? How about the developing glut of semiconductors, people? That was flagged by Micron not that long ago. We have way too many chips and the glut will only be exacerbated as the Chinese economy continues to slow down.”

Fifth, the trade dispute with China is starting to weigh on the economy as the U.S. scales up its tariffs on Chinese goods, and the stock market is essentially collateral damage, the “Mad Money” host said.

Sixth, the U.S. dollar’s rise will squeeze earnings forecasts and companies that are about to report earnings, a foreboding sign for the welfare of the broader market, he said.

Sell-off remedies

How can the stock market reverse its dramatic decline? Cramer saw four potential recovery drivers.

First, Fed Chair Jerome Powell “needs to walk back his comments” about raising interest rates, possibly even aggressively, to combat the strength of the economy, Cramer said, reiterating earlier remarks on the central bank’s leader.

“The problem is President Trump keeps putting Powell in a box by saying what he did today, which is exactly what I’m saying,” he continued. “So now I think Powell feels the need to dig in his heels and talk about the dangers of being too soft on inflation.”

“Shame on them. I don’t want 2007 again. You don’t want it either,” the “Mad Money” host said.

Second, the price of oil needs to reverse course and start declining despite how it might effect major oil producers, Cramer said.

“We’ve created a shortage with the new sanctions on Iran [and] we don’t have enough crude in this country to make up for the shortfall,” he said. “If oil doesn’t come down, there’s no saving the industrials and the transportation [companies] from commodity inflation.”

Third, transportation costs need to come down, and for that to happen, the country needs more truck drivers, Cramer said.

“The issue here is safety regulations that limit the number of hours truck drivers can spend on the road each week,” he explained. “Believe me, I get why these rules exist – you don’t want people driving 18-wheelers with no sleep. But now that these rules are in place, the trucking companies really need to start hiring some younger drivers to make up the difference.”

Fourth, the U.S. could use a break in its trade war with China, Cramer said, adding that it “doesn’t matter which side blinks as long as we get some reassurance that things aren’t spinning out of control.”

Final thoughts

Cramer’s final advice for investors was simple: “Don’t fight the Fed, don’t fight the tape.”

“When the Fed tightens, you need to accept the fact that the stock market is going to go down if it tightens too aggressively. And it is going down. Then it makes sense to do some selling,” he said.

And if the Fed refuses to take a step back and review the economic data before implementing its scheduled rate hikes, Cramer could see the sell-off lasting a bit longer, so patience is key.

“Look, nobody ever got hurt taking a profit. We did some for my charitable trust today,” he said. “But I wouldn’t be surprised if we get an oversold bounce in the next few days and it’s going to give you a better chance to sell if you’re really in a panic mode. However, that doesn’t mean the bounce will last.”

“As we come down, though, some opportunities may be worth nibbling [at] soon for the long term,” Cramer continued. “I wouldn’t be surprised if you get an even better buying opportunity down the road, [so] don’t be a hero. I sanction picking at some of the fast growers tomorrow. Nothing aggressive – it’s not worth it.”

What’s happening with Square?

This is Square this year. It’s been a super winner for all of us — until very recently.

Last night we heard the reason: Square’s brilliant CFO and CEO heir apparent, Sarah Friar, is leaving.

SQ will fall even more this morning. SQ’s stock price has been pushed up by talk of a takeover by some financial behemoth — like one of the big banks.

Friar’s departure could actually hasten that. If you want to hedge your bet, sell half your Square — but wait until 10:30 AM, when prices often bounce a little.

Amazon has dropped

It’s dropped 14% from its peak this year of $2,050. I haven’t sold any. But I suspect this morning it will hit my 15% stop loss number.

This presents a difficult decision for me, since I really like Amazon. But it clearly is overpriced. Its P/E is 139. Priced not only for perfection but also for Bezos brilliance. I suspect the bloom may be off Amazon for now — no matter how many things I buy from it. Buy it back cheaper.

The last few months

They’ve been wonderful I’d wake up each morning and admire what a genius I was. I knew that rising stock prices would end. They had to. But I had no idea when or why. One of the Rothchilds was asked what the secret was to his phenomenal wealth? He answered, “I sold too early.”

I’d hear that in my brain. Yet, I figured I was smart enough to smell the turn and get out in time. I didn’t. It’s still hard to believe it could be over for now.

In coming days there’ll be bounce. That won’t mean it’s all over. Just a good opportunity to loosen up.

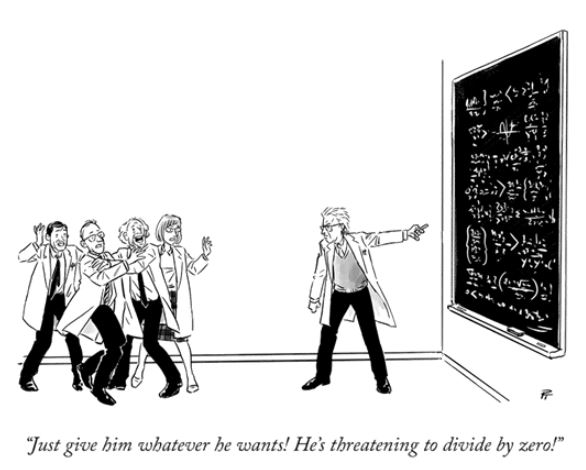

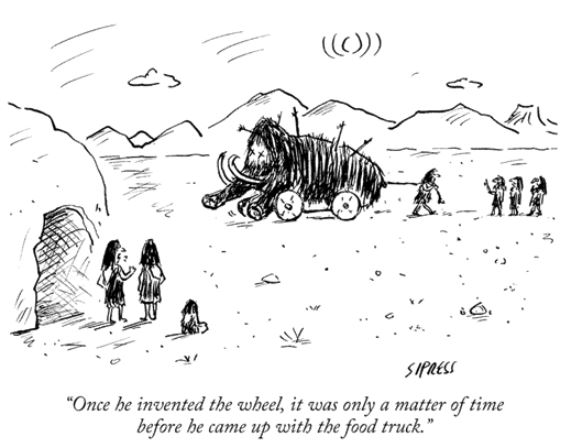

Favorite recent New Yorker cartoons

Harry Newton, who is mulling on housing, whose value is declining. I see it in Manhattan, where apartment sale and rental prices have dropped dramatically. Ditto for southern California. I’m watching. There’s new world out there. The moral of this lesson remains: Don’t buy holiday homes or second apartments. Rent them. Airbnb, VRBO and others are the way to go. Maybe even a hotel.

To be grateful: I’m grateful that I’ve kept readers out of whole sectors like automobiles. Look at Ford this year. Miserable. While tech stocks where flying, Ford was crashing…

Harry, my guy is predicting an 80% drop in the market. But I have very, very little invested. You see I’m a Trump supporter and we WANT the market to tank. We want it to go to zero or close to it. I love seeing you rich people up at night unable to sleep. I love it when your hair falls out due to stress and you have heart attacks…Trump supporters want the 1% to jump out of high rises in Lower Manhattan, just like on 9/Eleven. MAGA! MAGA!

I cut the following view from a stansberry analyst who has been very good:

The broad U.S. markets suffered their worst one-day decline since February’s volatility panic. Both the Dow and the S&P 500 fell more than 3%, while the tech-heavy Nasdaq led the decline with a 4% loss.

While sharp declines like these can be jarring, we’ll remind you not to get too bearish yet.

As we’ve discussed many times in recent months, all of the most reliable stock market, credit market, and economic indicators we follow continue to give the “green light” today. They tell us it’s still too soon to worry about a true bear market or a recession. History suggests the “Melt Up” will continue.

But we’ll also remind you that this doesn’t mean we can’t see further downside in the near term.

As we’ve noted many times, history also suggests sharp bouts of volatility – like the one we experienced in February – could become more frequent as the Melt Up plays out. During the last Melt Up in the late 1990s, market-leading tech stocks soared nearly 200% over the last year and a half of the bull market. Yet they also suffered more than six different corrections of roughly 10% along the way. We could easily see something similar this time around.

In other words, if you want to profit from the Melt Up, you must be prepared for more volatility…

the same analyst this morning: The point of the CAPE ratio is to attempt to smooth out distortions caused by the business cycle. So it looks at 10 years of stock prices and earnings (along with inflation) – not just one year, for example.

Over the past 25 years, it’s done a reasonable job of smoothing things out and getting to the heart of the matter. For example…

The CAPE ratio peaked at the end of 1999 – right around the stock market peak. And…

It bottomed in March of 2009 – which is exactly when the stock market bottomed.

You can see these two points in the chart below:

undefined

The dot-com peak is obvious. And so is the 2009 bottom.

One other obvious thing is the trend of the CAPE ratio today. It’s going higher – fast. When investing nerds (like me) see it heading toward those dot-com highs again, most of them get very worried. Then, they draw a big conclusion… They say, “Crisis is imminent! The CAPE ratio says so.”

I would like to share an alternative view on this seemingly obvious conclusion…

(I call it an “alternative view” because roughly 100 out of 100 academics would likely disagree with me on this – but I hope they read what I have to say with an open mind.)

Here’s what I have to say:

My fellow investing nerds, the CAPE ratio is about to fall – dramatically – by the end of next year. (And that assumes no change in stock prices.)

If that happens, the CAPE ratio will be below its long-term average value going back to 1996.

Sounds crazy…

However, a couple things are about to happen to the CAPE ratio between now and the end of 2019 that nobody is talking about at all.

Keep in mind, what I’m saying has nothing to do with predicting stock prices… Stocks don’t have to do anything for this to happen. The CAPE ratio will fall dramatically even assuming stock prices are flat. (The “P” in P/E ratio is left unchanged.)

Instead, two interesting changes are on the horizon for the “earnings” part of the equation. (I’m talking about the “E” – the denominator in the CAPE.)

Analysts estimate that the earnings number used in the CAPE ratio will skyrocket to a level of 163.1 at the end of 2019, versus the current number of 122.5.

Bad earnings numbers from the Great Recession of 10 years ago, in 2008-2009, are about to fall out of the denominator of the CAPE ratio, pushing the denominator higher. That means the overall CAPE ratio will be lower, even with no change in stock prices.

That’s right… Higher earnings estimates are just part of it. The “secret helper” that will drive the CAPE down later in 2019 is simply the calendar.

By 2019, 10 years will have passed since the terrible earnings numbers from 2009. Removing a bunch of small numbers from the denominator (from 2009) and replacing them with large numbers (from 2019) will cause the denominator to get larger…

For example, earnings numbers of around 8 or so in early to mid-2009 will be replaced with earnings numbers like 153.9 in June 2019 (based on analyst estimates). That is, obviously, a massive difference.

Between soaring earnings and the “calendar secret,” the CAPE ratio is set to fall dramatically by the end of 2019… Far enough that could actually fall below its long-term average since 1996.

To show you this, I created a year-end 2019 estimate for the CAPE ratio. Here are the assumptions I used:

No change in stock prices.

Inflation of 2.3% at year-end 2019 (the consensus analyst estimate).

Earnings that reach 163.1 at the end of 2019.

Under these conditions, take a look at what happens to the CAPE ratio by the end of 2019…

undefined

The CAPE ratio falls – dramatically – even assuming no change in stock prices.

And even if stock prices rise dramatically from here (as I expect they will during the “Melt Up”), these changes mean valuations will not start skyrocketing anytime in the near future.

That’s the really important part… You see, stock prices don’t actually have to fall soon at all. Stock market valuation is only a symptom at a top – it’s not a cause of the end of a bull market. And in any case, these estimates show stocks are not expensive today.

Well, that’s my story.

I’m still sure 100 out of 100 academics will have a problem with what I’ve said here… They have already decided that stocks are expensive because of the CAPE ratio… and therefore, stock prices must fall starting very soon. And there’s no changing their minds… at least for now.

Valuations look artificially high to some folks right now. That’s all going to change when these earnings changes kick in.

So, fellow investing nerds, what does this actually mean for you and your money?

I strongly believe we will see a dot-com style Melt Up before we see the big fall the academics are predicting. You ain’t seen nuthin’ yet…