Yesterday was euphoric. A huge gain.

The first email I received:

The stock market will move up from here to year-end in my opinion. Election uncertainty gone, Trump now cannot afford to have a trade war harm the economy. So no recession in sight. Buy. You heard it here first.

The email came from a friend of a friend, who knows. Maybe.

Remember this chart? It showed hefty stockmarket gains after mid-terms:

This year has not been euphoric (in contrast to last year). It’s been downright stomach-churning. Here’s NASDAQ this year:

Here’s a long term chart of Nasdaq showing the two big drops in recent memory– 2000 and 2008.

You’ll notice where we are today: A huge ten years since 2009. And squirrely lately.

It’s been several days since my last blog. During the days, I read and read to figure where we go from here.

First, are we likely to have an early recession? No.

Second, is there a Black Swan Event that going to mess things up? Yes. That’s the nature of Black Swan Events.

Does anyone have any idea of what it might be? No.

This hasn’t stopped every guru and his uncle from guessing. For example,

Greenspan Sees 7 Big Risks

+ Ballooning U.S. federal budget deficit

+ Soaring inflation

+ Falling U.S. national savings rate

+ Falling productivity

+ Bond market bubble

+ Undercapitalized banks

+ Trade wars

Hank Paulson warns of an ‘economic iron curtain’ if the US and China can’t find a way to get along. The former Treasury secretary told the Bloomberg New Economy Forum in Singapore that the US risked triggering a “full-blown” cold war and isolating itself from the region if it could not mend its differences with China.

There are many more gurus who are equally clueless about something as complex as the huge American economy, which — by all measures — seems to be doing just fine.

My belief is there is one overaching “problem:

There’s too much money around for too few opportunities. Hence money is chasing bad deals, over-inflating asset values and generally creating an unstable situation — especially if you factor in borrowed money.

Borrowed money gone bad has lead to more recessions and more market crashes than any other single cause.

Do I see anything especially worrisome on the horizon? No.

My personal investment strategy going forward:

+ No borrowings.

+ Plenty of cash invested in highly liquid instruments, like treasurys and bank CDs.

+ Sticking with my favorite stocks and looking for new ones — in areas I like — e.g. the cloud.

+ Accepting the fact that I can’t be right all the time. I missed Twilio. It surprised me.

+ Acceptance of the fact that some of my favorite stocks are priced beyond perfection. That’s something I have to live with. For example MSFT has a P/E of 46; GOOGL 42 and CRM 140. By any measure AAPL is a bargain with a P/E under 20. Being down 11% from its peak this year makes it somewhat of a “bargain.” My list of charts is in the right hand column on the web site. Click here.

There are too many pot stocks.

Every day I receive pitches for cannabis companies. Yesterday, I got one for a 250,000-square-foot cultivation facility, one of the largest Florida. I saw one recently for a million square feet in California. By now I’ve seen enough pot factories to grow marijuana to toke the entire world lighting up several times a day.

I’m not a pot consumer. I’ve been warned that the weed I liked 40 years ago has become 1000 times more powerful. And positively dangerous. The legal pot shop I visited recently in Denver warned me off their stuff. Even their weakest was hugely strong.

I got another release: Experts at Arcview Research predict the global legal marijuana market is expected to reach $146.4 billion by the end of 2025 and will see a compound annual growth rate of 24.9% from 2017 to 2025, “meaning the best opportunities may still be ahead for investors.”

I bet there were a zillion tobacco companies early on also. Now there’s a handful.

Am I sufficiently intelligent to pick two or three pot companies that will make it?

No way.

Fascinating book reviews and articles

+ Preserving the Wealth That Conservation Built. Click here.

+ The worst drug crisis in American history. A journalist says the opioid epidemic didn’t have to happen. Click here.

+ Looking Back at the Economic Crash of 2008. How a Decade of Financial Crises Changed the World. Click here.

+ North Dakota’s soybean crops are flourishing. But China has stopped buying. Click here

Don’t do stupid

+ Turn the water off in your home when you leave. I’ve heard several stories of burst pipes flooding several inches throughout the house and causing immense damage. There are gadgets that will allegedly turn your water off at the first leak. Don’t trust them. Just turn your water off. Easiest. Surest.

+ Before you buy anything, think how easier it is to rent it. That includes everything from homes to cars, from furniture to toys. The “sharing” economy includes Airbnb, VRBO, Turo, etc. There are places you can rent toys. Recommended Baby’s Away. Click here.

+ Get a flu shot. I just suffered through three weeks of a bad cold. Not pleasant.

+ Renting and using potentially dangerous vehicles without proper instructions is the No. 1 cause of injury when traveling, according to the travel-insurance division of American International Group: riding mopeds, participating in Segway tours, using jet skis for the first time, etc.

+ Before you try to fix anything, check the YouTube video. There’s a video on fixing anything and everything. It’s very easy when you see how.

Greatest stocking stuffers — 7″ luggage tags

Set of 3 for $39. Each extra tag $12. Your address goes inside.Click here.

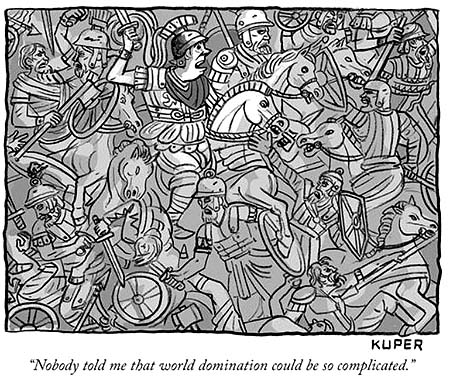

Favorite recent New Yorker cartoons

Harry Newton. I love the world domination cartoon. Reminds me of investing today.

Harry, how do you feel about muni bonds as an investment?