My first headline on today’s blog was “Why you should never own Apple. And why I’m shorting it.”

I could be completely wrong — IF Apple pulls a magnificent product out of its hat, and makes us gasp again, as it did with the original iPhone.

That’s a BIG IF. (And you’ll read a lot more below.) Meantime there are serious reasons to be skeptical of AAPL, the stock:

+ Apple has completely misjudged China. It’s hard to see an early recovery there. See below.

+ Since Steve Jobs died, there hasn’t been much serious innovation. Tim Cook is an operations, logistics guy, not a product visionary.

+ Netflix is leaving the Apple Store because it’s decided it doesn’t need Apple, which charges a hefty 30% commission on Netflix sales. Others will leave also.

+ As the stock price falls more good Apple employees will bail. Much compensation at Apple is stock based.

+ The basic problem is that Apple’s products are way overpriced. That’s a real problem when your competitors’ products are now so darned good and people are holding onto their phones for much, much longer.

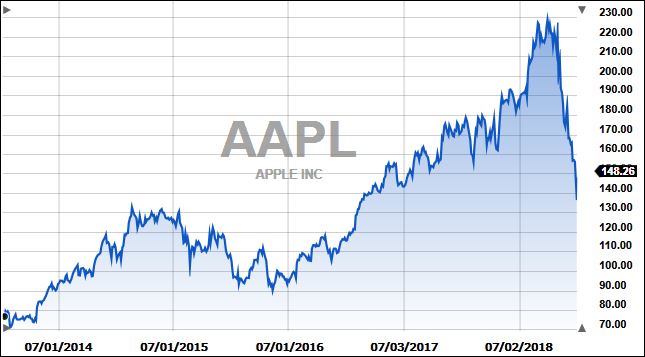

This is Apple over the past five years. Impressive until Tim Cook’s warning of early December.

First China. Here’s a January 5 piece from the New York Times:

Why My Chinese Dad Switched From an iPhone to a Huawei

And what that tells us about the fate of Apple in China.

By Yuan Ren, writer and former editor at Time Out Beijing.

I got my first iPhone during Chinese New Year in early 2012. It wasn’t anything I’d aspired to own. I wasn’t particularly techy, nor could I afford the brand as a graduate with a starting salary.

But at a dinner with an old friend of my father’s, the friend gave me, along with other knickknacks, an iPhone 4. My gift came with a caveat, however: It wasn’t the sought-after 4S that had caused a frenzy around the country after its release in January. Mine was a simple iPhone 4 – released in 2010, and by then considered already past its prime as a formal gift. That meant I was almost certainly a secondary or even tertiary receiver of the phone – China’s gift-giving culture is all about regifting – but back then, the Apple brand carried enough cachet that my father’s friend still saw it as good enough to give a close friend’s daughter, if not quite prized enough to present to a business partner.

That was back when Apple was still the phone to own for a Chinese person on the make, and when people like my father and his friends – mostly older, and in senior positions in large organizations – were still caught up in the legend of the Apple product, even though most of them, including him, had no idea how to use most of the features. That didn’t matter; it was enough to know that iPhones were “the best.” Their global reputations came with an assurance of both status and quality.

What’s happened in the interim? A lot. When Apple’s chief executive, Tim Cook, warned investors on Wednesday that the company was facing slowing sales in China, the wider world seemingly greeted the news that Apple had lost its China mojo with shock. But for those who are smartphone users in China, the news just confirmed what we already knew: China’s domestic brands have made huge strides in the years since 2012, creating new features and products that take into account what Chinese users want, for a small fraction of the price. Apple, meanwhile, has mostly failed to localize or reinvent itself, on the assumption that global cachet would be enough.

The homegrown groundswell began with a little-known brand called Xiaomi, which burst onto the scene in the early 2010s as one of the first brands in China to have its own operating system, and offered high-speed processing on the cheap. At first it appeared to cater to a completely different market than Apple. Selling entirely online, Xiaomi offered both a low-end model – the Redmi for as low as 699 yuan (then under $150) – and a higher-end model that was still far cheaper than the cheapest iPhone (less than 2,000 yuan, then under $350).

But with time, the useful features on Xiaomi products, as well as those of its competitors like Huawei and OPPO, combined with the price, began to outweigh the increasingly limited glamour of the iPhone. I myself transitioned to a high-end Xiaomi from an iPhone in early 2014 after a young professional friend of mine, who worked in marketing in Shanghai, raved about the Xiaomi Mi Note, which is one of the big-screen models, or “phablets,” that have long been popular in China and East Asia, where many prefer the bigger screens – Huawei’s latest measures a whopping 7.2 inches – ideal for taking selfies and watching TV dramas. (Apple released its Plus series in late 2014 with larger handsets, which did send its sales shooting up in China – but also added $100 to an already expensive price tag.)

Apple also long resisted the rise of another important local feature: the dual SIM card system, a component that may sound boring but for Chinese people has become essential. In China, where many young people have never owned laptops, phones have become all-in-one devices – part television, part computer, part phone. Transitioning between two SIM cards on all other cell brands is a seamless process: one card for streaming and downloading at cheaper rates, the other one for making calls. Growing international tourism has also raised demand for phones that can accommodate a second, foreign SIM – and yet for years, Apple didn’t budge. The company finally gave in to the dual SIM card in the form of special models for China and Hong Kong last fall.

It’s telling that the main example of Apple localizing its products to China in the last few years was a special model gold-colored iPhone. First introduced in 2013, it was a clear play for the Chinese market, and was, admittedly, a huge hit on the mainland. Many joked that the gold iPhone was targeted at the tuhao, a recent term that roughly translates as “tasteless nouveau riche” and that mockingly refers to the wealthy who feel the need to show off. The color was even given the name tuhao jin, or tuhao gold.

But the allure of gold-colored plating – a feature focused not on user experience but aesthetics – goes only so far, it seems. And it may not be enough at this point to keep even the tuhao loyal. Huawei, China’s largest smartphone maker by market share, recently overtook Apple to move to second place globally. Its popularity among the wealthy and business class at home has shot up in recent years; its prices have been steadily rising as it shifts focus toward higher-end products. Many upper-middle-class Chinese who once owned iPhones have since switched to Huawei – including my dad.

As China has moved online en masse, it has, perhaps, surprised some analysts who believed that the appeal of high-end brands as status symbols would drive decision-making for years into the future. It turns out that Chinese consumers care about user experience, too (and price, of course).

But the iPhone hasn’t lost all of its luster. A civil servant friend of mine was still offered a brand-new iPhone as a “gift” in 2016; I’ve yet to hear of anyone who was bribed with a Huawei.

Now to the world picture. Rarely have I come across investment writing as brilliant as this long piece on Apple by bloggist, Bob Lefsetz. Mr. Lefsetz has agreed to let me publish his entire piece. Read and enjoy. You’ll understand a lot about the business of technology as an investment.

Apple

This is what happens when innovation dies.

We’ve seen this movie before, with Sony. Sony developed the Trinitron television system, which was definitely better than its competitors, sharper, more true. And it charged about a hundred dollars more, when TV sets cost far from a thousand bucks. And then the whole world went to flat screens and Sony’s business went kaput. So it went into software, buying a movie studio, installing rapists as its heads, and ended up writing down billions. Now Sony is just another Japanese company. Used to be their audio equipment was revered, at both high and low ends, remember the Walkman, what a breakthrough! But no one overpays for Sony anymore, it’s an also-ran. One can argue the company plummeted with the death of Morita, same as Steve Jobs.

So Apple became so valuable when it owned a product category, the iPod, and kept diversifying and lowering the price of said music player.

This was in the era of hardware innovation. What came next was the iPhone, a juggernaut. But after Jobs died, it was decided that the iPhone would become an exclusive product, an aspirational product, that the masses would hunger for.

And then they didn’t.

Used to be every upgrade was a wonder. From the 6 to a 7 one could notice the incredible increase in speed and the quality of photographs. Jump from a 7 to an Xs and you find the only real difference is the lack of a home button. Suddenly, mobile phones are like computers, you upgrade them once every five to ten years, otherwise there’s no reason. Used to be as soon as you brought your computer home it was outdated, we were fascinated by the discussion of chips, now most people have no idea of the speed of their computers, they’ve become a commodity, just like mobile phones.

While Apple was busy trumpeting its margins, saying it was the only entity making money in the smartphone sector, Chinese competitors worked to undercut them, to the point where today they’re almost as good. But the worst thing in China was Apple was undermined by WeChat, where most mobile phone owners in China spend their time. That’s software innovation, which Apple has been sorely lacking. Hell, Siri was first and now it is last. Amazon develops Alexa and keeps lowering the price and owns what market share Google doesn’t pick up. Meanwhile, Apple is so busy refining and overpricing its HomePod that it’s dead on arrival. Sure, it sounds better, but if I’m that interested in sound I’ll go to the stereo shop, the ones that still exist, turns out most people don’t care about sound quality these days, or are unwilling to pay for it. Furthermore, HomePod doesn’t play with competitors’ services. This strategy works when you’re the leader, not the follower, when your product supersedes others, the HomePod certainly does not.

And then there’s the music fiasco. Waiting too long to get into streaming. And then integrating files and streams into the same hobbled app. Kinda funny for a company that was known for killing legacy ports. You leave the past behind, you keep pushing the envelope.

Meanwhile, Wall Street loves the numbers. Like a pop act riding its very last hit. No one can see the disaster coming, because in America, everyone’s focused on the money.

But just like a band, tech companies are dependent upon hits.

As for the vaunted ecosystem. By missing WeChat, by not buying WhatsApp, Apple stood by while its competitors made inroads into its main business.

And the prices keep rising.

In tech we expect prices to start fair and then drop, meanwhile, the price of an iPhone has climbed into the stratosphere. You no longer have envy, your handset is good enough.

And with so many on so many devices you’re no longer judged on the device you’re using. Most can’t tell. And purchasing one used to be a no-brainer, now it’s like buying a car, are the payments worth it?

I’ve been trumpeting the fall of Apple for years. And been excoriated for it. But it’s akin to Kodak and digital cameras. The fall came late, and then it happened overnight and was complete.

You buy a new phone when you need one, not when you want one.

Microsoft’s Surface is the desktop replacement, not the iPad Pro.

Apple’s Macs are an afterthought and usually behind the tech times. They employ the same Intel chips as the competition’s computers, it’s just that they’re installed late and kept for far too long. Replacers are yearning for hot machines, and Apple doesn’t deliver them.

Sure, Apple makes the best phone. (You can argue about this, but let’s not.)

Sure, Apple has the best ecosystem. (Google’s is close, but no cigar.)

Sure, Apple has the best designed products. (But not by much anymore.)

Sure, Apple has the best service. (By a long shot.)

But is everybody willing to pay for this?

No.

Meanwhile, the vaunted world’s most valuable company has lost that position, hell, even Microsoft has superseded Apple in value, primarily because of innovation in the cloud, and in addition the Cupertino company lost a double digit percentage of its overall value.

Let this be a lesson to you. Nothing is forever. And never underestimate the power of a leader, and the power of the public. The public can change preferences on a whim. And then they oftentimes switch to a new individual, a new leader, a new record producer, like Max Martin. You’re hot, and then you’re not.

What made Steve Jobs so legendary was his ability to see where the market was going, what the public wanted, years before anybody else. And sure, not all his ideas were brand new, but the execution was superb. Anybody can have a good idea, but bringing it to attractive fruition? That’s a whole `nother thing.

And icons are not easily replaced. We’ve been waiting for a new Dylan for sixty years, but he has not shown up.

Where is the new John Lennon?

We’ve got very good, sometimes even great, but iconic?

That’s rare.

Sure, Jony Ive is a top-tier designer, but he needs to be told what to do.

Tim Cook is incapable of that. Categorically. He’s a logistics expert. It’s like making the head of promotion the head of the label. Promotion is important, but signing and nurturing acts is a different skill, and the talent, the tracks, are the most important part of the enterprise. It’s like having a world class factory with nothing to make.

And when you’re on top, making change, you’re excoriated.

And quite possibly crazy. Steve Jobs could be a bully, he had no time for manners. Elon Musk does not know there are rules, whether they be business or societal.

But it is these geniuses we yearn for, who change the world.

There’s no one like this at Apple today.

The company faded once, it can happen again. There is no catalogue in tech, it’s all what have you done for me lately. It’s about retaining talent and taking risks. Amazon failed with the Fire phone and then came up with the juggernaut known as Alexa. Apple kept polishing its jewels until suddenly no one wanted them anymore.

Oh, that’s not true.

How do you lose your fortune?

Very slowly, then all at once.

Lefsetz is here.

ON January 3, The Wall Street Journal ran a piece:

Apple’s Troubles Extend Beyond China

Confluence of events raises doubts about iPhone maker’s business strategy

Apple Inc. chief Tim Cook blamed China’s accelerating economic slowdown for stumbling iPhone sales that hurt its global revenue in the past quarter. The company’s problems run deeper in China and extend to markets beyond.

Chinese rivals including Huawei Technologies Co. are selling feature-competitive smartphones at lower prices, squeezing Apple’s share of the world’s largest smartphone market.

Meanwhile, it has faltered in the biggest untapped smartphone market, India, where Apple accounts for a scant 1% of overall sales, according to market estimates.

Mr. Cook also acknowledged trouble at home in his letter to investors on Wednesday. In the U.S., Apple has been stung by smartphone owners lengthening the amount of time they hold onto their devices.

The confluence of events poses a formidable challenge for a company whose revenue has grown 11-fold in the iPhone era. With global iPhone sales stagnant, Apple isn’t able to rely on big emerging markets for explosive growth. And it hasn’t yet found a transcending product that can offset the lost iPhone revenue.

After Mr. Cook highlighted the problems in China in a revenue warning Wednesday, Apple’s stock fell 10% on Thursday to $142.19, its biggest single-day percentage drop in nearly six years. The slide wiped $74.65 billion from the company’s market value.

At Apple’s California headquarters Thursday morning, executives held an all-hands meeting to address questions about its performance, including the company’s monthslong stock slide, said people familiar with the matter. Some employees have a significant portion of their compensation tied to restricted stock units. and, among other things, are concerned about when to pay taxes on them

Apple’s stock has fallen nearly 40% since peaking Oct. 3 at $232.07.

The growth problem is exacerbated by Apple’s reluctance to change its profitable strategy of selling a limited number of devices at premium prices. Apple didn’t fully appreciate that its pricing power has diminished in price-sensitive markets, analysts say, the result of cheaper rival products, a lack of compelling new features and slowing economies, particularly China.

“There’s nothing Mr. Cook said to make you believe there are disruptive opportunities for Apple around the corner,” said Tom Plumb, president of SVA Plumb Financial, a Madison, Wis., wealth-management firm. It has $2.6 billion in assets and counts Apple among its top holdings, though it sold some shares in the past two months. “They’re still a leader in many areas, but as large as they are, they need something really big,” Mr. Plumb said.

In his Wednesday letter, Mr. Cook said the company is “confident and excited” about its product pipeline, adding that “Apple innovates like no other company on earth, and we are not taking our foot off the gas.”

One component of Apple’s strategy long considered its greatest weapon: an ability to charge ever-higher prices for its marquee device.

The average selling price for the iPhone has increased 12% over the past four years to $749.63 in fiscal 2018, helping to make up for slowing unit sales. When Apple said last year it would stop reporting unit sales for its iPhone and other products, the company signaled sales volume wasn’t as important as pricing, said Wayne Lam, a mobile analyst at IHS Markit.

That strategy appears in trouble.

“The price elasticity snapped” in the fourth quarter, Mr. Lam said. Apple misread the market because it has always been able to sell iPhones at premium prices, he said. “There’s going to be a lot of soul-searching within management now.”

Mr. Cook acknowledged that the forecast revision would prompt review. “We manage Apple for the long term, and Apple has always used periods of adversity to re-examine our approach, to take advantage of our culture of flexibility, adaptability and creativity, and to emerge better as a result,” he wrote in his letter to investors.

Apple often had the ability to forecast iPhone sales “to the third decimal,” said Daniel Ives, a Wedbush Securities analyst. That is what makes the revision so stunning, he said. “This is the biggest miscalculation by Apple in the iPhone era.”

The macroeconomic issues cited by Mr. Cook probably accounted for about 20% of the shortfall, Mr. Ives said. “Eighty percent of it is that Apple just swung and missed,” he said. “Fundamentally, this was an Apple execution issue.”

A prime example of Apple’s execution woes is the iPhone XR, its more modestly priced device among three new handsets it released last fall. For China, Apple had placed big orders for the XR, anticipating strong demand after it went on sale in October, according to a person familiar with the matter.

Apple is now grappling with excess XR inventory, this person said, a tough pill to swallow for a CEO who once described inventory as “fundamentally evil.”

Apple may have underestimated how competitive domestic smartphone makers have become, analysts say. With a starting price of 6,499 yuan ($945), the XR is priced well above a competing model from Huawei that also launched last year, the Mate 20, starting at 3,999 yuan. The Mate features a triple camera system while the XR features only a single camera.

Apple’s iOS operating system also is less of a selling point for Chinese consumers than in other markets because smartphone users spend a large chunk of their phone time inside WeChat , a chat, payments and social-media app from Tencent Holdings Ltd. that is identical on phones running Google’s Android software.

The company has weathered poor performance in China before-sales there dropped in both fiscal 2016 and 2017. But those moments usually were negative blips in otherwise stellar quarters of growth, fueled by the runaway success of the iPhone. Now, Apple is facing greater challenges at home.

The iPhone’s first decade was driven by significant innovative leaps in everything from battery life to screen quality to camera performance. Two-year contracts from mobile-phone carriers coupled with subsidies for devices drove recurring sales.

But the breakthroughs have slowed, said Chetan Sharma, a mobile-industry consultant. While some changes in recent years, such as bigger screens with the iPhone 6, goosed iPhone sales, consumers in developed markets these days aren’t jumping to new models as quickly as before.

Just four years ago, U.S. consumers upgraded phones every 24.4 months, according to BayStreet Research LLC, which tracks device sales. The upgrade rate hit 36 months in the quarter that just ended, the firm estimates.

And it expects the length U.S. consumers hold their phone to average 38.7 months over the course of this year.

Average sales prices of iPhones are nearly five times the average price of non-Apple smartphone sold globally, according to Sanford C. Bernstein analyst Toni Sacconaghi. That discourages upgrades, he said.

Melissa LeRitz used to upgrade her iPhone every two years. But the 29-year-old quit doing so when her phone provider stopped covering the majority of the cost. Her iPhone 7, purchased a couple years ago, still works fine, she said-even without some fancy new features.

“I kind of find it ridiculous to spend $1,000 on a phone when there’s not really too much of a difference,” said Ms. LeRitz, an attorney in Medford, Ore. “I feel like they are churning them out so quickly I can’t keep up anyways.”

Mr. Cook said in his letter that Apple is trying to counter the trend in part by making it simpler to trade in a phone in stores and finance the purchase of a new one over time.

If Apple keeps its premium-pricing strategy, customers might hold on to their devices even longer and prospective new customers might opt for cheaper alternatives. Dropping prices to lure more buyers will pressure its margins and could cannibalize sales of its premium devices.

“It’s a challenging and arguably intractable issue that Apple faces,” Mr. Sacconaghi said. “There’s no easy solution.”

The above article came from the Wall Street Journal. Click here.

The last article I want to point you to is from Gizmodo:

APPLE

What Happened the Last Time Apple Had a Panic This Bad

On Wednesday, Tim Cook issued a dire, surprising, and historic warning to his company’s investors. Apple, the world’s first trillion dollar company, would be lowering its revenue forecast for the first time since 2002, thanks in part to bad iPhone sales and China (basically). But wait, you’re thinking, what the hell happened in 2002?

2002 was a weird palindrome of a year, one that many remember as the last rush of suffering after the dot-com bubble burst. In June of that year, when Steve Jobs told investors that Apple’s quarterly revenue numbers would fall $200 million short of its estimates, the Nasdaq Composite Index looked like the icy part of a black diamond ski slope. The entire tech industry had been sliding steadily from its peak in early 2000, but the full collapse was still months from bottoming out. Jobs explained the situation bluntly in an Apple press release:

“Like others in our industry, we are experiencing a slowdown in sales this quarter. As a result, we’re going to miss our revenue projections by around 10%, resulting in slightly lower profits,” said Steve Jobs, Apple’s CEO. “We’ve got some amazing new products in development, so we’re excited about the year ahead. As one of the few companies currently making a profit in the PC business, we remain very optimistic about Apple’s prospects for long-term growth.”

And that’s all Jobs said at the time. As John Gruber points out, the entire Apple statement, including that Jobs quote, clocks in at less than 200 words and can be summed up as: Numbers look bad, but Apple’s about to blow your mind with some new stuff. Tim Cook’s letter to investors on Wednesday is around 1,400 words and noticeably lacks that charismatic call-to-action around exciting new Apple products on the horizon. The closest thing we get to that is a funny line about how the company is going to make it easier to trade-in new iPhones in some winking effort at suggesting that the Apple’s aging cash cow hasn’t completely lost its way.

Back in 2002, the iPhone obviously didn’t exist, and Apple was still furiously begging consumers to take its computers seriously. It was an incredibly interesting time. The first iPod had hit the market in October 2001, and at the Macworld Expo the following January, a beaming Steve Jobs revealed the iMac G4. You know, the one with the 15-inch LCD floating on a chrome arm connected to a compact white base with a shiny Apple logo on the front. The crowd gasped when Jobs did the big reveal.

Then that earnings panic happened, and to be sure, Apple stock took a hit. By the end of 2002, you could buy a share of the company for $14.33, a near 40-percent drop from the beginning of the year. This actually would have been an amazing time to buy Apple stock, because things turned around for Steve and friends after that. In April of 2003, Apple released the iconic third-generation iPod and launched the iTunes Music Store, where you could buy a song for 99 cents that could only be played on an iPod or Mac computer. The concept seemed sort of crazy at the time, but Apple’s entry into the digital music market would be the beginnings of a services business that’s now second only to iPhones in the company’s revenue stream.

If you want to think of 2002 as the year Apple sulked its way through the end of the dot-com bubble bursting, you can think of 2004 as the year the iPod took over. That summer, Newsweek put Steve Jobs on its cover, and Duke University gave new iPods to all incoming freshman. Apple also released the iPod Photo with a color screen that some might consider an early sign that the company would one day create a do-everything mobile device. Three years later, Steve Jobs announced the iPhone as “a widescreen iPod with touch controls,” a “revolutionary mobile phone” and “a breakthrough Internet communicator.” In other words, a new iPod that does a couple more fun things, including, eventually, the ability to buy apps on a mobile device. In the third quarter of last year alone, Apple generated $18.2 billion in revenue from app sales.

To put that number into perspective, Tim Cook’s big warning to investors this week amounted to his announcing that Apple would bring in $84 billion in revenue this quarter instead of the projected $89 to $94 billion. So $5 billion short. Just as it was in 2002, the company is dealing with growing pains generated by a slowing global economy and a slowdown in hardware sales. This time around, Apple’s bad numbers are just bigger.

The other big difference, of course, is that Apple seems to be lacking in the “amazing new products in development” category Steve Jobs mentioned back in 2002. It’s remarkable how the years that followed Apple’s last panic were marked by profound growth and innovation. The iPod’s legendary run would pale in comparison to the explosion of change sparked by the iPhone’s release, not to mention the steady success of the MacBook Air, the iPad, and the Apple Watch. And yes, the Services business is making a lot of money, too.

Maybe that’s just it, though. Maybe this present day Apple panic is just bookending a profound moment in history when one company could do no wrong. Maybe Apple’s heyday of invention and innovation are behind it, and now the company has to find a future in streaming video services, artificially intelligent voice assistants, and augmented reality software. Apple’s recent hiring habits would suggest as much.

Some of these pursuits are bound to be profitable, and Apple’s next quarter will probably be less embarrassing than this one. The company’s fans, especially those that remember Steve Jobs on stage in 2002, must also be wondering: When’s Apple going to make us gasp again?

Gizmodo’s piece is here.

Is Apple worth shorting — even at these ultra-low prices?

I believe it could easily fall another 20 or 30 points. Shorting is dangerous. But the “good news” is that it’s hard to see a big upside for the stock from here. Hence, you have a sort of “stop loss.”

Harry Newton, who will short Apple today. I apologize for the lack of jokes today. I’ve done a lot of work on Apple — even buying a competing Samsung Galaxy Note 8 to test it compared to the iPhone. The Samsung Galaxy works well — sometimes better than my iPhone 8 plus — especially on WiFi Calling (which T-Mobile has mastered, but Verizon hasn’t).

Would like to hear your opinion on Apple vv Brk. Should I be buying or avoiding BRK???

I’m buying Apple hand-over-fist, Harry. I’m also putting in buy orders well below where it’s presently priced. I wish your blog was better read so you’d drive down the price. Let’s check back in a year and then again in 3 years to see who was right.

This investment thing isn’t static. At some point — well below where it’s presently priced — Apple will be worth buying again. Maybe they’ll have some new exciting products that will make us gasp.

Harry, Mike Nash’s big buy theory should be a confirmation on your short postition.

The fly in the oil is that as the market heads back up from this correction, Apple could rise on sympathy. Good Luck,

We’ll see. We’ll take this one step at a time. I once mailed some ideas to Tim Cook (in a paper envelope) of things I wanted improved on the iPhone software. I got a curt abrupt reply that said they didn’t read user suggestions. I’ve never sent them anything since.

The basic problem is that Apple’s products are way overpriced. – Hi Harry, I am glad that you finally realize this basic problem. You can’t charge customer over $1000 for a phone while other phone company can do with much cheaper price. Any empire will have its end day even Steve Jobs is still alive.

My LG smart phone gives me enough smarts for normal calls, text, emails, photos, weather plus much more I never use and not sure I know how. I use Tracfone…my wife’s little used flip phone stopped working, contacted Tracfone and they replaced it with the fancy smart phone plus 3000 minutes use plus data at no cost! So, I now have a smart phone which does not get a great deal of use (no kids) so only costs me around a hundred bucks per year. When I contact any company for any reason (often running 30-60 minutes) I always use Skype so it does not use-up time on my .03 cents per minute Tracfone.

Apple wasted the talent of Jony Ivy and others on the design of its $5 Billion+ Spaceship HQ instead of doing what Amazon, Google and others do and just use regular office buildings and focus on products.

Boy, are you right.