Amazon is bouncing back from its Christmas low of $1,307.

Giving disgusting a whole new meaning:

The brother of Jeff Bezos’ girlfriend is being accused of selling her out for $200,000, leaking sexually explicit texts and photos sent between Lauren Sanchez and the world’s richest man. The Wall Street Journal says Michael Sanchez leaked the texts and photos to the National Enquirer, who then reported that Bezos was having an affair with the former TV personality.

Fortunately it’s not affecting the stock nor Amazon’s business. I bet she’s not talking to her greedy, moronic brother.

Updated list of stocks we like

Check out the right hand column.

Cockroach stocks and the bulldog press

When sh*t happens, when the first cockroach appears, the press will assign reporters to cover the evolving, unfolding story. They’ll dig up even more stuff and make the impact even more severe on the company’s stock. (Maybe.) Hence today’s New York Times story:

F.A.A. Approval of Boeing Jet Involved in Two Crashes Comes Under Scrutiny

As regulators at the Federal Aviation Administration reviewed designs for Boeing’s newest passenger jet, they paid extra attention to several features, including the lithium batteries, the pressure fueling system and the inflatable safety slides.

One feature that did not receive exceptional scrutiny: a new software system intended to prevent stalls.

That same software is suspected of playing a role in two deadly crashes involving the same jet, the Boeing 737 Max.

…The 737 Max was one of the first commercial jets approved under new rules, which delegated more authority to Boeing (employees) than had been the case when most previous planes were certified. And the software system did not raise warnings during the approval process. Top F.A.A. officials, who are briefed on significant safety issues, were not aware of the software system, according to three people with knowledge of the process. …

The scrutiny adds to the pressure at Boeing, an aerospace giant with a strong safety record. The 737 Max, its best-selling jet, has more than 4,600 pending orders, which are expected to bring in hundreds of billions of dollars in the coming years.

The plane is now grounded as the company races to come up with a fix to the software. It is unclear when the jet will start flying again. …

The new, more efficient engines on the 737 Max were larger and placed in a different location than previous generations. To compensate for the new aerodynamics, Boeing installed the software, which would force the nose of the plane down in certain circumstances. The goal was to help avoid a stall.

I guess Boeing assumed that its software was more competent than the pilots flying the plane! Awesome chutzpah.

To read the full New York Times piece, click here.

Investors have a recent love affair with Boeing and have bid the stock up recently. It was also 2017’s best performing big stock.

I suspect that Boeing will solve its problem in coming weeks. My temptation is to put in a buy order around $350 and see what happens:

FedEx missed earnings — a reflection of slowing world trade. I’m seeing FedEx CEO Fred Smith on TV. But not Boeing’s CEO, who’s hiding under a rock somewhere?

I bet FedEx is a screaming buy around these levels.

Latest in real estate:

From today’s Ross Rant by Joel Ross:

Real estate marketing and design is being heavily impacted by the internet and sites like Zillow. There is now no need to drive around and only see what the broker wants to show you or tell you. Now you see all properties, and a lot of data about the asset. You can also learn all about the demographics and other aspects of a neighborhood including all the comps. Buyers are far better informed. This is true for residential as well as commercial. Google Earth even allows you to see the building, and the area from various views. In commercial, it is now possible to find potential properties to acquire without the use of a broker to go seek out deals. There are also auction sites which are legit. Over time, brokers will find that they are less critical to some transactions, and their commissions will likely decline as their value is diminished in many situations. There is now a lawsuit attacking broker commissions on residential. You should negotiate the commission. It does not have to be 6%.

How you should manage your money

Also from today’s Ross Rant:

I was accidentally sent the wealth management statement for a person I do no know, by UBS. The account was a retirement account with around $1.5 million of value. I was curious, so I looked it over. Frankly, I found the way UBS handled the account deplorable, but not unusual for typical money managers. The person who owned the account got screwed. UBS invested money across a very large number of stocks, mutual funds and ETF’s. 200 shares of this, 300 of that, 200 of another. Money managers seek to not lose money in retirement accounts, so they spread the funds across so many stocks and funds, that no one stock can do major harm. But they buy so little of everything, the investor never really makes any real return. The investor would have been better with an index fund and nil fees. But the investor does only so-so. Many of the shares in that account had been purchased in 2003 and 2004, and held since. 40% was in cash. The return since opening the account in 2003 was 50% over 16 years. That is disgraceful. If the sole goal was preservation, then they could have bought an A, or BBB rated corporate bond, and done as well or better since 2003, with no fees to the manager.

If you have a material amount of money, say between $1 -15 million, then choose 10, or maybe 20 stocks you firmly believe in and buy $125,000-$400,000 of each. Obviously it depends on how much you have to invest, and allocate proportionately (if you only have $1 million then maybe 7 or 8 stocks is all), but either you believe in the company, or not, and if not, invest nothing. So long as you have 15 or so different, good solid growth stocks, in different industries, you should be fine. Strong financials, strong management and a leading product line are keys to solid investments. My point is, either commit to invest, or just buy an index fund or an investment grade bond, and go to sleep. Why pay a money manager 75-100 basis points to spread your money around a bunch of stocks that could just as well have been chosen by a dart board, and leave a sizable amount in cash or bonds.

To subscribe to Joel Ross’ interesting newsletter called Ross Rant, click here.

Classic nasty, dangerous pfishing

Download the wire at your peril.

25 most beautiful places in Paris

For the Conde Nast Traveler list and article, click here.

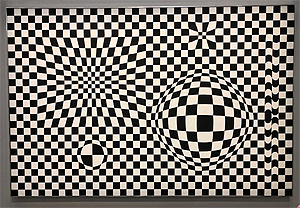

I love Victor Vasarely. There’s an exhibition of his work at the Centre Pompidou. Here are three of my favorites, shot with my iPhone 8 plus. (Hard to get them squared.)

Playing tour guide in New York City

New York has five wonderful shopping experiences,which you must visit

1. The new Nike store on Fifth Avenue. It’s stunning. I visited it yesterday to see if Nike’s stock is going to $100. It is. See below.

2. The Uniqlo store — a hundred yards from Nike. Known for its down jacketry, they have oodles of jeans and t-shirts, etc. The place is mobbed with European visitors who can’t believe the cheap prices and high quality.

3. The B&H photo store on ninth Avenue. It has every camera and photo gadget you ever imagined and more. Two things impress: Salesmen knowledge. The store’s automation. It’s a great place to compare cameras and ask for expert advice.

4. Hudson Yards has just opened. Cost $25 billion. Apparently the shops are stunning. I haven’t visited yet — maybe today. It’s west of Penn Station:

5. When you’re done spending your money, go to the Eataly restaurant complex at Fifth and 23rd. For more, click here.

Giving to the Lord

Courtesy Reader’s Digest:

The priest says to the poor farmer: If you had a horse, would you give it to the Lord?”

“Yes.”

“And if you had a cow?”

“Absolutely.”

“And a goat?”

“Sure.”

“A pig?”

“That’s not fair,” protested the farmer. “You know I have a pig!”

Harry Newton, who loves the Fifth Avenue Nike store, which features a half basketball court:

You can play on the court. The floor lights up as you move around. It’s neat.

The best things about the store are all the technology exhibits on how Nike makes its sneakers. Awesome technology. Awesome design.

Nikes are terrible shoes. Just awful if you do any kind of running or fast walking, and that includes your tennis game. The company is all about promotion and spends virtually nothing on its products other than giving their shoes a “cool look.” But real runners, of which I consider myself (I’ve finished the New York City Marathon eight times) HATE, and I mean HATE, Nikes.

Zillow works great for selling private real estate…last year I sold a house in the first 12 hours it was listed on Zillow, to a lady in North Carolina…the house is in Sun City, AZ. This year I sold a condo in Sun City to a retired college professor who lives in Flagstaff…she was the first person to look at the condo. i saved thousands and thousands of dollars in real estate commissions…the title company did all the work for a little over a thousand dollars which I would have had to pay anyway, on top of a hefty real estate commission. There was no listing fee on Zillow…the pictures I added did the job.

Harry – under your “Giving disgusting a whole new meaning” write-up – do you not find it just as/if not more disgusting that a married man with children couldn’t resist proudly snapping photos of his “privates”, and then sharing them with his mistress via the Internet?

Just saying…….

That’s private stuff between the two of them. Didn’t affect anyone else.