Buying is out.

Renting is in.

Here’s why: Housing prices are falling. It’s no longer worth keeping your money in a house.

When I bought my various houses, I always assumed they would be a good investment. I’d buy a nice house, in a nice location, fix it up and, sell it later for a nice profit.

No more, I’m just selling a house I bought about ten years ago for 27% less than what I have into it. I’m told I’m lucky to find a buyer. I should accept the loss “and move on with my life.” Sage real estate broker advice.

It wasn’t always this way. I I bought a loft in Manhattan in the 1970s and sold it 25 years later for nine times what I paid for it.

But the 1970s were bargain times in New York real estate.

The last time there were “bargain” times in housing was in 2008 and 2009 when the economy tanked and home and apartment owners were under water (their house was worth less than their mortgage). Many walked away and gave the keys back.

Since then, home and apartment prices have roared back. Many real estate gurus are now arguing that housing is way over-priced and prices are falling. See here.

Wait there’s more. My brokers, like Nan Schiff of Douglas Elliman, tell me sentiment (especially in New York) has changed dramatically. Buyers are increasingly looking at their housing options as an investment. “Should I really put $3 million (or whatever) into an asset that is falling in value?”

They look at $3 million. Earning 8%, that’s $240,000 a year. Add the maintenance they’d pay – let’s say $5,000 a month, or $60,000 year. That adds to $300,00 or $25,000 a month. For that much money you can rent a pretty nice house or apartment anywhere.

But wait, there’s more. That calculation is for your primary home. What about a holiday home?

I own a holiday home in a gated community in California. There are two issues here: First, the maintenance is high and rising regularly. Second, the management is weird. They make decisions that, to my mind, make little sense — but cost the members (like me) serious money.

And now for the best news: We now have Airbnb, VRBO and zillions of other home-sharing companies. In the last year, our family have used these home sharers to rent a gorgeous house in Hawaii, a super-located apartment in Paris (within walking distance of the Louvre) and an apartment in Kensington, London that was quaint, comfortable and within walking and bus-ing distance to the best London museums and toy stores (for the grandkids).

At the end of our stay, I hand back the key and tell them of the needed maintenance — like a blocked toilet (not my fault), or a lose towel rack and walk away. No more dealing with contractors who don’t show. Sheer pleasure!

Then there are also hotels, who are not enjoying the home-sharing competition. Get on the phone with a nice hotel, tell them you want to stay for a few days. They’ll offer you a suite with a view, free breakfast, and hot and cold running blondes. (I’m kidding. But you get the idea.) I just got a great deal in Ljubljana, Slovenia, where Michael and I are going biking in late Summer.

But wait, there’s even more. The cost of owning second, third and fourth homes has just gone through the roof. Mr. Trump’s tax reform means that I can only deduct $10,000 of real estate taxes a year… My California house alone was around $20,000. Further the value of these second homes is really falling through the floor. I’m selling my California house for 27% less than I have in it — the price I paid plus several improvements, like a new AC.

Then there are the heavy income taxes in states like New York, Connecticut, New Jersey and others that had the misfortune of not voting for Trump. They got whacked. Residents can no longer deduct their state income taxes. Many are saying, “I’m sick of this. I’m selling out. I’m moving to Florida. And I’ll rent a nice apartment there. With the Internet I can run my business from there. And I don’t have to pay for snowplowing my driveway.” They’re dumping their houses.

Hence there are several fundamental factors driving down the price of real estate – especially pricey real estate.

Susan and I have vowed: Our days of multiple houses are over. We’ve already booked an Airbnb house for Hawaii next Spring break. It will accommodate lots of children and grandchildren. And it’s near a nice quiet beach with an en-suite restaurant. When we leave, we leave the key.

That’s my epiphany for the day!

The market tanked yesterday.

Traders panicked and sold out yesterday because of the “on-again, off-again” China Trade Deal.

One day they’ll have a deal and the market will come back.

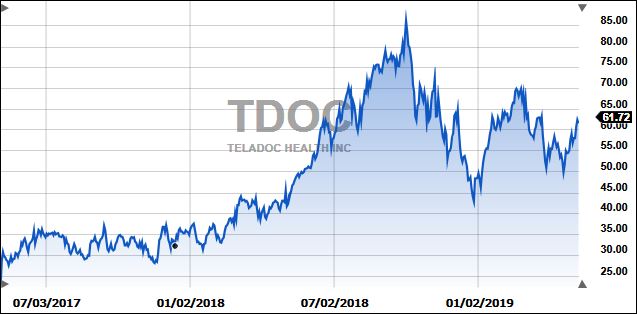

Meantime, the BIG key remains: Put in ultra-low BUY bids and hope you get filled. Cramer was talking about TDOC last night. The company is all about talking to a doctor remotely. TDOC is apparently doing well. The point of all this is putting in low bids. Look how well you would have done if you could have snagged some TDOC at $45 or $50.

Posting today’s blog

I’m posting this blog on the computer I took to tennis. It’s not my main one. So, sorry, no jokes. I can’t even joke about losing this morning. I’m devastated — more than I was yesterday in the market.

Harry Newton, who has lost the hibiscus. No one seemed to like it, especially my sister, Barbara, who lives in Australia and just sold her house for 23% less than she asked for. Housing prices down under are also cratering. There are better things to invest in — than houses. More about what they are tomorrow. Stay well.

Right, “people are dumping theIr houses in Blue states” and moving to red states.

So any day now I’ll be able to buy a Blue state house for next to nothing..what a relief!

You’re out of the loop, yes where you are real estate may not be a good investment, now! Wait till 2020; new administration that sweeps out the corrupt Republicans and sentiment changes fast! Down here in Florida, we are doing just fine, by the way!

I have to agree with Stephen. I’m n Miami Beach and it’s a buyers market, I picked up a nice 2br condo at a fair price and a $377 condo fee. Both agents and appraisers view the market down here as very stable. I rented in NYC for years, with $1500 maintenance fee’s I could never buy there. Not to mention no state taxes here!

You seem to be realizing that the real estate picture is only bad in extremely high tax “Blue” states where people are dumping their houses and moving to another state with more reasonable taxes and politics. Real estate in Phoenix is very hot.

Yes…Phoenix is really hot in other ways too…that is why we are summering in our inexpensive summer home near Payson, AZ where the mountains are high and the temps low.

You must be talking lower end houses in Phoenix. The high end is definitely not hot. I’ve been looking for a home in the Phoenix area for about a year now in the $1 million to $1.5 million price range and the same houses that were on the market a year ago are almost all still on the market only with big price cuts.

I believe the market is highest for working people moving here as well as retirees who are on more modest incomes and escaping high tax states. Many are in the rapidly expanding tech firms which offer higher but more modest incomes. Retirement homes sell in the low 100s while newer developments are in the mid to upper 100s. Multi-millionaires may be looking at lower cost seasonal homes and condos as opposed to palatial estates.