This is Morgan Stanley this morning on CNBC:

It’s nonsense. Just words from a high-paid analyst paid to comfort worried clients that Morgan Stanley will take care of them.

Which it won’t.

Ironically, today’s big upwards bounce is in tech stocks, like AMZN, MSDFT, HPQ and GOOGL.

We may or may not be bouncing back from a heady recent sell-off. This chart is the past six months. the red line is a 200-day moving average.

We’ve bounced back more times than we have crashed.

I want to watch it for a few more days before I issue a blanket “Get back into tech stocks” announcement.

I’m staying well away from tech stocks with problems, like FB, NFLX and NVDA.

Real estate mortgage maven LADR continues to perform well for us. It’s still showing a handsome 7.4% yield.

I’m proud of keeping my readers away from disasters like GE and bitcoin.

I got my $100,000 back — finally

Everyone blamed everyone — including the two banks, the lucky recipient and me. It was a two week total waste of everyone’s time and temperament.

It all started thus: I placed a wire with my bank online system. Someone at the bank interrupted my online wire, and held it. (No one knows why.) Their Fraud Dept then got involved. They contacted me. I said the wire was fine. Meantime, the Wire Dept sent the wire. But forgot to tell the Fraud Dept, which also sent it — a second $100,000 removed from my bank account.

No one can figure why my bank — one of the largest and erstwhile most sophisticated in the world — would send my wire twice. They’re launching a big investigation.

I’ve suggested to my bank that I deserve a $250 Amazon gift certificate for the two weeks of agita they gave me.

I’m not holding my breath.

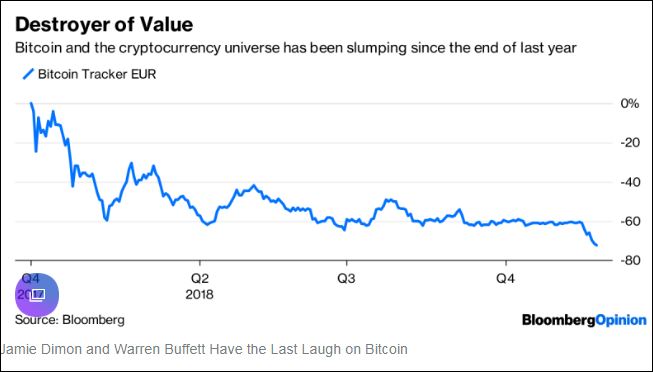

Whatever happened to bitcoin? Yuch!!

Down 80% in 12 months. Chart, courtesy Coinbase:

This article courtesy Bloomberg:

Jamie Dimon and Warren Buffett Have the Last Laugh on Bitcoin

(Bloomberg Opinion) — Bitcoin turns 10 this year, but there’s not much to celebrate. Its price has tumbled to near $4,000, down 30 percent in a month, 50 percent in six months and almost 80 percent since December.

The cryptocurrency experts, who clearly didn’t see this coming, are blaming all sorts of temporary culprits – from jittery markets to “hard forks” (blockchain jargon for radical technical changes in a digital currency). But they’re kidding themselves. This is a long-term unraveling of all of the lies, exaggeration and populist fantasies that drove last year’s market mania.

Bitcoin was meant to make all of its investors rich, something that held particular appeal to a millennial generation hungry for a financial boost in a world of crushing student debt, income inequality and low-quality jobs. It was meant to be free of Wall Street’s corruption and the U.S. government’s meddling technocrats. It was meant to be secure, with a price that would go ever higher. For the hardcore evangelists, it would reward its acolytes when the inevitable financial apocalypse arrived. The dollar was destined for scrap.

And it was meant to show that we should all stop listening to fuddy-duddy “experts” like Jamie Dimon, Warren Buffett and Jack Bogle. The old, closed ways of investing would be usurped by the buying power of the masses.

Unsurprisingly, none of this has come to pass. The Bitcoin bubble of 2017 – mercifully short and economically contained – has enriched only insiders such as mining companies and crypto-exchanges, and the early birds and tech elites who cashed in at the right time.

For the patsies who arrived late to the party, it has been a tool of financial impoverishment. About $700 billion has been wiped from the value of digital money since January. One Korean teacher told the New York Times in August: “I thought that cryptocurrencies would be the one and only breakthrough for ordinary hard-working people like us.”

Nothing on the Bitcoin label turned out to be in the bottle. As a means of payment, it is cumbersome, volatile and expensive. It has destroyed value rather than storing it. Its decentralized technology was sold to investors as being unique. It has been anything but.

Those “hard forks” have created numerous Bitcoin spin-offs over the past year, and the vested interests of those who make money from doing this – by shifting their own coin to the new spin-off, bringing the miners along, and effectively taking control of the new currency – have triumphed over the dreams of a neutral blockchain system that would treat everybody equally.

Even the hedge fund folk, who thought they could use sophisticated options to bet on the boom while covering their downside, have been proven wrong in a market where prices and information flow are not transparent – and are often manipulated.

Of course, bubbles and crashes are a part of history. If regulators and journalists do their job of warning consumers of the risks – and they did with Bitcoin – then why shouldn’t people be free to do what they like with their cash?

But while Bitcoin is on the ropes, it certainly hasn’t gone away, and global regulators still need to find an effective way to rein in the cowboys. And while this hasn’t been a systemic risk this time, the eventual spread of digital currencies will mean that isn’t always the case. Finally, if the frustrations that drove people to chuck their savings at a virtual Ponzi scheme aren’t resolved, we’re only setting ourselves up for bigger political trouble down the line.

To contact the author of this story: Lionel Laurent at llaurent2@bloomberg.net

Will tariffs bring jobs back to America — in a word, NO

A Winter-Coat Heavyweight Gives Trump’s Trade War the Cold Shoulder

Columbia Sportswear has worked around tariffs for decades – and it says the president’s new wave of levies will not bring jobs back to America.

For the full story, click here.

Keep moving (my motto)

Regular Exercise May Keep Your Body 30 Years ‘Younger’

The muscles of older men and women who have exercised for decades are indistinguishable in many ways from those of healthy 25-year-olds.

Read more. Click here.

Two Christmas presents I’d like

The Trek Powerfly 5 electric bike. $3,800.

I love electric bikes. This one is handsome and great technically. Every one should ditch one car and buy one of these. Perfect for getting around town. Click here.

Bose QuietComfort 35 (Series II) Noise Cancelling Wireless Headphones.

These headphones are extraordinarily comfortable. You can use them with your cell phone. The headphones have a mic. They will work with your TV if it has a Bluetooth out or you plug in the 3.5 mm supplied audio cord. They’re best on a plane when they kill the engine noise and let you sleep or watch the movies in total quiet. I mean total quiet. They come with a nice case. But it’s not small. Click here.

This is funny. Very funny.. Watch it tonight. It’s long.

If the YouTube video doesn’t work, click here.

Don’t do stupid

1. Don’t forget to get yourself a flu shot and the new Shingles Shingrix vaccine.

2. My friend fell off his treadmill, because he put it on “Pause.” When he got back on, it started fast and he got thrown.

3. Don’t even think of buying a vacation home — or what the British call, a holiday home. You can do much better with Airbnb, VRBO, Homeaway, etc. For more, click here.When you’re through, you hand the key back and the news of the leaking toilet, which you don’t have to fix.

4. Don’t ever participate in a staff motivational meeting. This is short and funny.

The joy of Thanksgiving travel

This is granddaughter Eleanor, now 5, at LAX waiting a flight home.

Older posts you may have missed

I’m not posting every day. Some days I have nothing to say. Here are my most recent columns:

+ There is good news and there is bad news. Nov 23 (Black Friday) Click here.

+ What I learned – if anything – from my recent huge tech stock losses. Nov 21. Click here.

+ Blood is flowing. Is now the right time to jump back in? Nov 20. Click here.

+ I lied. Not every asset is crashing. Nov 19. Click here.

+ Another day poorer. But not deeper in debt. Nov 15. Click here.

+Asset prices in free-fall: Stocks. Housing. Commodities. Nov 13, Click here.

+ Too much money. Too many opportunities. Hence today’s stomach-churning investment scene. Nov 8. Click here.

Harry Newton, who had a lovely Thanksgiving playing tennis every day and reading about global warming —‘Like a Terror Movie’: How Climate Change Will Cause More Simultaneous Disasters— click here — and Why the world needs to wean itself off coal but can’t — click here. Both articles are well-researched and worth reading.